ASX shares that have fallen hard but have a compelling future could be good opportunities if they're able to bounce back.

I do not believe the outlook is going to be uncertain forever for sectors like retail or real estate. The short term does look rocky, but I think we can find the best opportunities when times look tough.

By FY27, three years away, I think profit and investor sentiment will be much stronger for these two stocks.

Charter Hall Group (ASX: CHC)

Charter Hall describes itself as one of Australia's leading fully integrated property investment and funds management groups. It's invested in a variety of sectors including office, industrial and logistics, retail and social infrastructure.

It runs a number of real estate investment trusts (REITs) including Charter Hall Long WALE REIT (ASX: CLW), Charter Hall Retail REIT (ASX: CQR) and Charter Hall Social Infrastructure REIT (ASX: CQE).

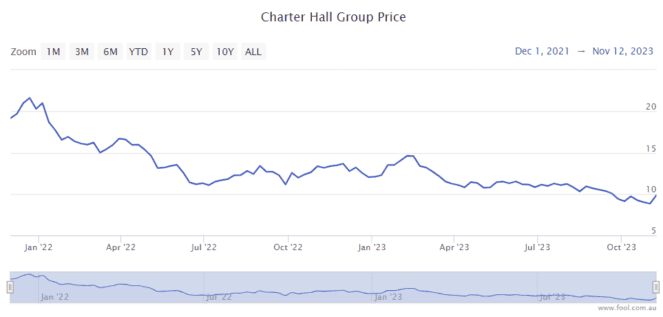

Amid the pain of higher interest rates, the Charter Hall share price is down over 50% since December 2021 and it's down 27% in the past year, as we can see on the chart below.

In FY23 the business saw property funds under management (FUM) growth of 9.5% to $71.9 billion. FUM growth is helping increase its management fees. The growing FUM and rising revenue are helping increase the earnings before interest and tax (EBIT) margin.

Investor sentiment could recover in two or three years, which may make this beaten-up ASX share look remarkably cheap. According to the projections on Commsec, the Charter Hall share price is valued at 13 times FY24's estimated earnings with a possible distribution yield of 4.6%.

Universal Store Holdings Ltd (ASX: UNI)

This is an ASX retail share that operates a national store network of Universal Store outlets, it has the THRILLs and Worship brands. It's also trialling the Perfect Stranger brand as a standalone retail concept.

At the start of FY24, the business was seeing its sales decline year over year, which is part of the reason why the share price has suffered. After the increase in the cost of living, shoppers may have less to spend at the company's stores in the short term.

I like that the business is expanding its store network because that can cushion any same-store sales weakness impact on total sales.

In FY24, the business is expecting to open a further four to six Universal Store locations, five to eight new Perfect Stranger stores and one to two new THRILLS stores.

Importantly, the company said that its gross profit margin was remaining "steady", it's carefully managing its inventory, and it's managing its costs in several ways, including distribution centre enhancements and store labour "optimisation".

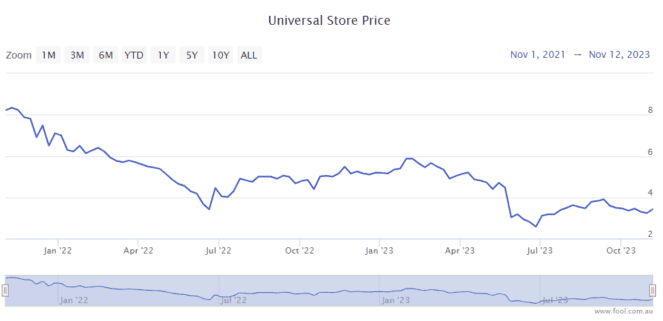

I believe buying retailers during a (forecast) downturn can be effective because when retail conditions recover it can experience a larger bounce than other sectors because they have fallen harder. For example, a share price falling from $100 to $90 is a fall of 10%, recovering back to $100 would be a rise of 11.1%. A 50% fall from $100 to $50 is a 50% fall and recovering back to $100 would be a rise of 100%.

As we can see on the chart below, the Universal Store share price is down 37% in 2023 and it's down 60% from November 2021. I'm not saying it's going to double in a year or two, but the retailer has declined significantly to a low price/earnings (P/E) ratio.

According to the projections on Commsec, the Universal Store share price is valued at just 8 times FY25's estimated earnings with a possible grossed-up dividend yield of 11.3%.