What if someone just handed you $800 each month and asked for nothing in return?

Passive income like that is what most of us dream of.

So how much money do you need to be able to regularly rake in that much to supplement your day job paycheque?

Let's go backwards to see what you might need to do:

This is how large your passive income machine needs to be

We'll start with assuming you can construct a portfolio of ASX dividend shares capable of generating 10% yield each year.

It's a fairly realistic goal to achieve, as Australia's franking rules often provide a nice boost to the headline dividend yield.

A passive income of $800 each month equates to $9,600 per year.

This means that a nest egg of just $100,000 can easily pump out $800 into your bank account every month.

So that's all good and well, but what if you don't have $100,000 just laying around?

Then you have to grow your pot first.

And this is how you grow it to that size

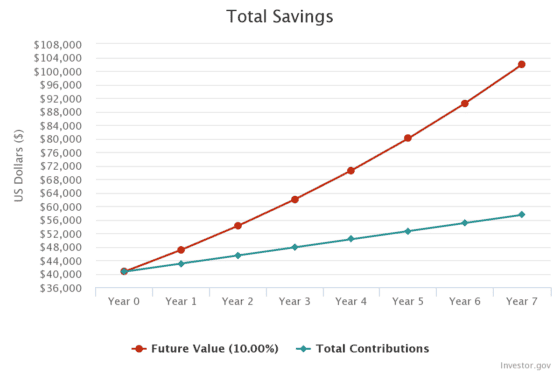

Comparison site Finder conducted research that found the average Australian has $40,617 of savings stashed away.

If you can start a stock portfolio from that, it's a great start.

There are a few different options from here.

You can either buy a diversified bunch of ASX growth shares, or stick with the dividend stocks mentioned earlier and simply reinvest the returns. Or even a combination of both.

Either way, let us again assume you can achieve a 10% compound annual growth rate (CAGR) and that you can add $200 to the investment each month.

That means that after just seven years, your nest egg will have grown to $101,920.

From that point on, harvesting the 10% returns each year will bring you more than $800 of monthly passive income.

Final word

Of course, past performance is never an indicator of the future. And there is no guarantee that you can achieve the returns mentioned in the above hypothetical.

But if you diversify the portfolio sufficiently so that your fortunes aren't beholden to one or two particular companies, industries, economies, or trends, then you give yourself a fighting chance to land that sweet passive income.

Good luck out there.