Hip hop legend Jay-Z would be the furthest person from investors' minds when they buy and sell ASX shares.

But did you know he actually sits on the board and owns shares in an S&P/ASX 200 Index (ASX: XJO) company?

If you own shares in fintech Block Inc CDI (ASX: SQ2), you are buying into a company that has Jay-Z as a director and investor.

In fact, just last month he added more Block shares to his portfolio.

The rapper, whose real name is Shawn Carter, disclosed that he was issued a total of 41,759 shares in early October. The stocks came to him under his own name, an "immediate family member", and through his holding companies.

Based on the share price on Wednesday morning, that's worth about $3.2 million.

So how did this come about?

How did Jay-Z join the Block board?

The short answer to Carter's involvement is that Block Inc acquired Carter's Tidal music streaming service in 2021.

The long answer is that Block Inc co-founder and chief Jack Dorsey spent the summer of 2020 in the Hamptons hanging out with Carter.

A friendship developed, and Dorsey came up with the idea of buying out Tidal, which was financially struggling at the time.

As part of the acquisition, Jay-Z joined the board of Block Inc.

Block Inc was later unsuccessfully sued by some of its own shareholders for the deal, who accused Dorsey of using company funds to shore up his friendship with a celebrity.

The Delaware judge actually agreed with this, but ultimately dismissed the lawsuit.

"It is reasonably conceivable that Dorsey used corporate coffers to bolster his relationship with Carter," Judge Kathaleen McCormick wrote in her ruling.

"Plaintiff has alleged sufficient facts to make a reasonable person question the business wisdom of the Tidal acquisition, but plaintiff has failed to plead that the committee defendants acted in bad faith and thus faced a substantial likelihood of liability for that decision."

No doubt those investors may have been less angry if the performance of Block shares were better.

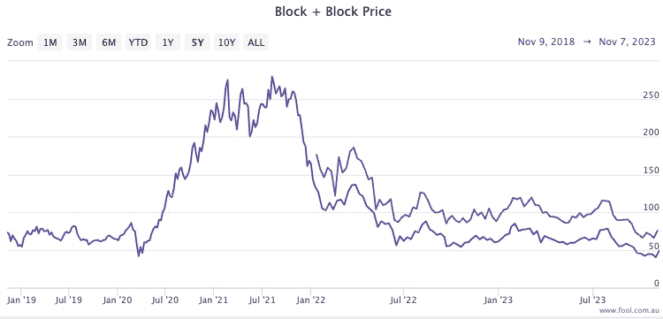

The Block share price has tumbled almost 80% since the Tidal deal closed in April 2021.

The stock joined the ASX in January 2022 after acquiring the Australian buy now, pay later business Afterpay.