I've been using the recent volatility to add some new names to my portfolio. One of the next investments I'd love to make is to invest in , S&P/ASX 300 Index (ASX: XKO) share Nick Scali Limited (ASX: NCK).

For readers that haven't heard of this business before, it's a furniture ASX retail share that was founded more than 60 years ago. It imports and sells quality furniture – over 5,000 containers of leather and fabric lounges are imported each year, as well as dining room and other types of furniture.

Let's get into why I really like the business.

High-quality retailer

The company has an extremely high return on equity (ROE), in FY23 it was more than 50%. This shows that the company is very profitable for how much shareholder money is retained in the business. It's very focused on doing the best it can for shareholders.

It has done a great job at growing the Nick Scali network to a national chain across Australia, with a small but growing presence in New Zealand.

The business recently grew its addressable market by acquiring the Plush business, which also gives the ASX 300 share a further national rollout opportunity.

At the end of FY23, it had 107 stores between the two businesses. Nick Scali thinks it can grow its overall store count to between 176 to 186 stores across the two brands in both Australia and New Zealand. The Nick Scali brand could rise to 86 stores, up from 64 stores.

There is also a chance that it could expand into another country where its business model could be successful, such as the UK.

I like that the business is working on paying down its (Plush) acquisition debt. It said that it paid down $20 million of debt in August 2023, which came after the business reduced its acquisition debt from $65 million at November 2021 to $48 million at 30 June 2023. The acquisition debt is now sitting at $28 million.

In the long-term, I think there's good potential for the business to grow its online sales as a percentage of overall sales, which would be positive because these sales can be very profitable.

Cyclical opportunity?

I think it's understandable that demand for furniture will go through cycles as the economy moves through periods of strength and weakness. Consequently, this can impact the Nick Scali share price and profit as investors assess how much they think the business is worth.

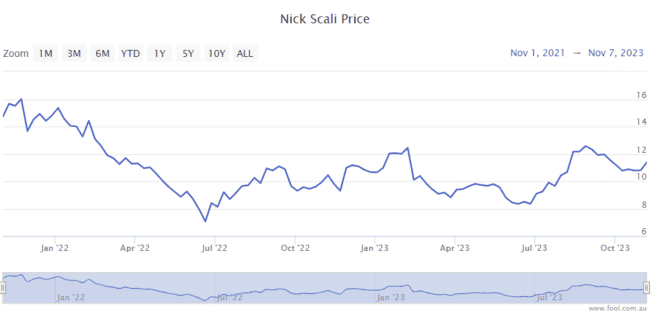

Times of decline for the ASX 300 retail share could be an opportunity to invest. If we look at the Nick Scali share price, it's down almost 30% from November 2021. It is down close to 10% from 31 August 2023.

However, as we can also see on the chart, the business has risen strongly since June 2023 and from the lows seen in 2022. That's why I haven't invested yet – the business has recovered quite impressively but I'm very eager to invest.

Strong dividend

One of my favourite things about the ASX 300 share is that it seemingly has a strong commitment to paying appealing dividends.

The business has grown its dividend every year since 2023, so it managed a decade of dividend growth for shareholders. I wouldn't expect that the FY24 dividend per share will go up because of the current uncertain outlook and the likely decline of profit in the current financial year.

Even so, Nick Scali is forecast to pay an annual dividend per share of 55.6 cents according to Commsec. If that ends up being the payment to shareholders, it would represent a grossed-up dividend yield of around 7%.

If the Nick Scali share price does fall then the potential dividend yield would increase, assuming the forecast dividend doesn't change.