If there are businesses that are set to grow from long-term global "mega trends", it gives investors confidence to ignore short-term fluctuations in the share price.

Shaw and Partners portfolio manager James Gerrish recently mentioned two such S&P/ASX 200 Index (ASX: XJO) stocks that his team is bullish on:

'People will need to store stuff'

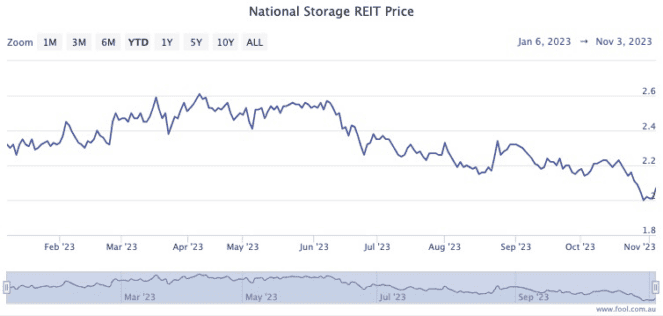

It's fair to say National Storage REIT (ASX: NSR) has had a shocking couple of months.

The shares plunged 8.3% during October, to add to the misery of a 6% decline in September.

That's a short-term dip that surely would have tested even the hardiest of long-term investors.

Gerrish's team, though, is not fazed.

"We remain committed to the mega trend that people will need to 'store stuff' as a trend toward higher-density living becomes more common through Australia's major cities," he said in a Market Matters newsletter.

In fact, the 18% correction since June has opened a buying window for National Storage shares.

"With a valuation of under 18x for FY24 and an estimated [dividend] yield over the next 12 months of 5.85%, we believe National Storage REIT has become a very compelling story," said Gerrish.

"We are considering averaging our NSR into any further weakness."

Indeed, the National Storage share price has recovered 5% in the first few days of November.

'An excellent strategic move'

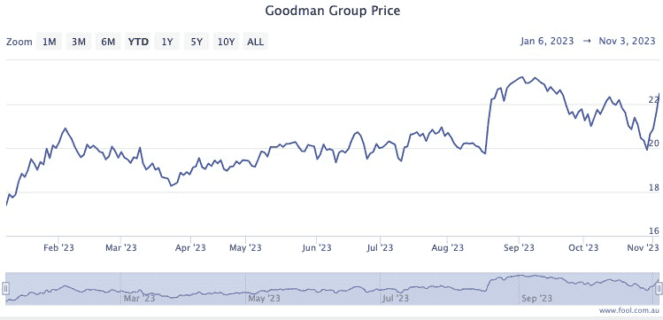

Goodman Group (ASX: GMG) shares are also picking themselves back up this month after declining for weeks.

From the end of August until 27 October, the industrial real estate manager lost 13.6% of its valuation.

It has since picked up more than 8%.

The company has already been a beneficiary in the global mega trend towards online shopping, but its new foray has Gerrish's analysts excited.

"We believe Goodman Group's expansion into data centres is an excellent strategic move, with demand for such facilities outstripping supply, as this new growth trend appears to be only in its infancy," said Gerrish.

"The surge in development of e-commerce and artificial intelligence, to name but two, generates the demand for data storage which translates directly into the demand for data centres."

His team remains "long and bullish" on the stock.