When short-sighted investors abandon certain ASX shares to send the price plunging, it could be a great time to buy them cheap with a long horizon.

Keeping this in mind, here are two discounted stocks that experts are rating as buys at the moment:

China's export controls could deliver a windfall

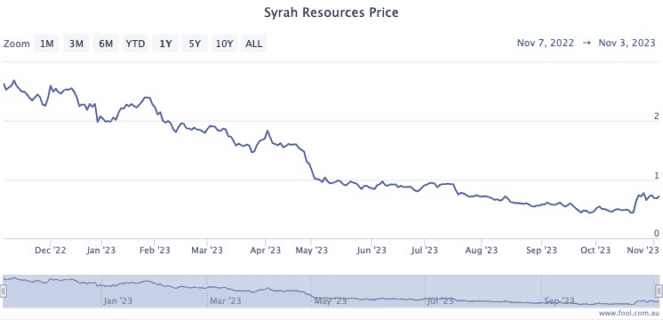

ASX graphite producer Syrah Resources Ltd (ASX: SYR) has seen its share price plummet a horrifying 81% from January to 19 October.

It has since exploded more than 65% then, but is still close to 70% down on a year ago.

Seneca Financial Solutions investment advisor Arthur Garipoli rates Syrah as a buy because it has some structural tailwinds underway.

"The Syrah share price recently soared on news that China was implementing export controls on graphite products from December 1, 2023," Garipoli told The Bull.

This is important because China is overwhelmingly the largest source for the mineral, while Syrah is the single biggest producer outside of that country.

"This graphite company operates the Balama mine in Mozambique," said Garipoli.

"We expect Syrah to benefit from China's decision on export controls."

According to CMC Markets, four out of five analysts that cover Syrah Resources now consider it a buy.

'There's a chance guidance could be upgraded'

Brambles Limited (ASX: BXB) shares have taken a nasty 6.3% tumble over the past fortnight, or an 11.4% dip if you go back to 12 September.

Sequoia Wealth Management senior wealth manager Peter Day is not concerned.

"This integrated supply chain logistics giant recently reported sales revenue from continuing operations of US$1.640 billion in the first quarter of fiscal year 2024, an increase of 15% at actual foreign exchange rates on the prior corresponding period."

Pleasingly, the global pallet maker maintained its 2024 financial year guidance.

After the recent sell-off, Day reckons Brambles shares are "trading on an attractive price-earnings (P/E) ratio compared to the historical long term".

"We believe there's a chance guidance could be upgraded."

Interestingly, the people running the company seem to also apparently think the share price will head up from here.

ASX records show Brambles chair John Mullen buying about $150,000 of shares last week, while fellow directors Kendra Banks and Nora Scheinkestel bought smaller parcels.