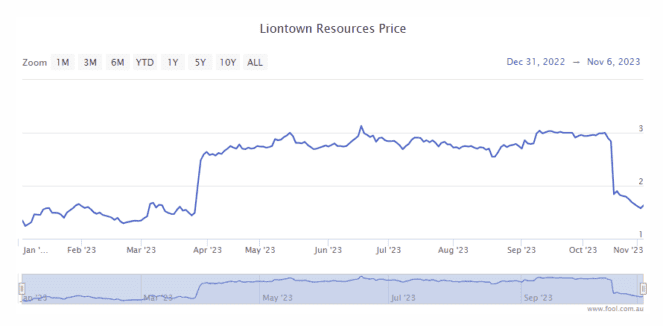

There haven't been too many S&P/ASX 200 Index (ASX: XJO) shares that have gone through more volatility in 2023 than Liontown Resources Ltd (ASX: LTR) shares. The ASX lithium share is up 34% in the year to date, as we can see on the chart below.

The company was the subject of a takeover attempt by US company Albemarle. However, the American business decided to walk away after Australian mining tycoon Gina Rinehart complicated the deal after one of her companies bought up almost a fifth of Liontown.

That rollercoaster may have been unsettling for the company's focus and for shareholders, but let's look at what could happen next.

What next for Liontown shares?

I think there are two main areas to consider.

The first is Liontown's progress in getting its Kathleen Valley project operational. Until the company starts producing lithium and making cash flow, it's not delivering on its potential.

In its latest quarterly update for the three months to September 2023, Liontown said it had awarded the final major mining and construction contracts for Kathleen Valley. This brought its committed capital costs to approximately 90%, "de-risking the pathway to first production", according to the company.

It updated its estimate of the Kathleen Valley Project capital cost, including pre-production mining, to first production of lithium of A$951 million. It said the average cash cost (C1) is expected to be A$651 per dry metric tonne (dmt) over the first 10 years of production.

Liontown said Kathleen Valley remains on schedule with a "clear line of sight" through to first production in mid-2024.

The company is currently in the process of capital raising, issuing new Liontown shares to a total of around $400 million to ensure it's fully funded to first production and beyond.

Now to the second consideration. The lithium price is important because it could influence how much profit Liontown is able to make once it starts production.

There has been a broad decline in both battery-grade lithium and spodumene concentrate prices. One of Liontown's lithium mining peers, Pilbara Minerals, recently said:

Demand for lithium raw materials is expected to remain consistent in Q2 FY24 which is typically a stronger period for EV sales. Market pricing for spodumene concentrate and lithium chemicals is however likely to continue to remain volatile in the near-term given uncertain macroeconomic conditions and closely managed inventories in the supply chain. The long-term outlook for lithium materials supply remains positive with an expected structural deficit of lithium materials supply relative to the expected demand for lithium-based products such as electric vehicles and battery energy storage.

Valuation snapshot

While the Liontown share price has risen this year, it's actually down 13% over the past 12 months. It's no surprise the lithium price was also at a much higher level a year ago than it is today.