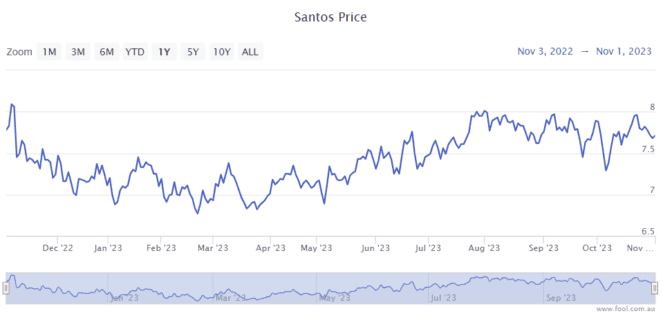

Santos Ltd (ASX: STO) shares could be an opportunity according to the fund manager L1 Capital. As we can see over the past year, it's extremely common for the ASX energy share to experience volatility.

Santos describes itself as one of the leading independent oil and gas producers in the Asia Pacific region, supplying energy to customers across Australia and Asia.

How L1 sees the energy market

L1 said that its portfolio is positioned towards businesses with a lower price/earnings (P/E) ratio that have "strong earnings growth and large cash flow generation."

The fund manager said that the outlook for the oil and LNG sector is better than market expectations.

Demand for energy "continues to grow" and L1 suggested that there is under-investment in new sources of supply. There has also been a surge in mergers and acquisitions activity, which could help Santos shares.

The fund manager said that in regards to growing oil demand, Chinese aviation activity is bouncing back and continues to rise thanks to Asian demand. It also noted the strategic petroleum reserve (SPR) has been drained and is now being replenished.

L1 believes investor positioning and sentiment toward the energy sector is "as bearish today as it was in mid 2020." That was when "COVID fears were extreme, driving/flying activity had collapsed, oil storage was full globally and the oil price was negative".

US hedge fund positioning is "at extreme bearish levels (98th percentile versus past five years)". In other words, hardly any hedge funds are invested in energy which is surprising considering the WTI oil price is above US$80 per barrel, there's the Middle East war, a favourable supply-demand outlook and oil inventories are at multi-decade lows.

Why are Santos shares attractive?

The fund manager said that Santos shares are "extremely undervalued" despite having a stronger growth outlook compared to its peers and significant capital invested.

L1 said that it recently proposed a demerger of Santos' domestic oil and gas assets, leaving the ASX energy share as a pure-play LNG company.

According to the fund manager's calculations, the Santos share price could have at least 40% upside based on a conservative sum-of-the-parts valuation, with further upside from energy market tightness.

L1 suggested that Santos could be an acquisition target because it has strategically attractive assets, with 80% of its asset value in low-cost, long-life LNG assets.

Santos share price valuation

L1 suggested that Santos was trading in October at an enterprise value to earnings before interest, tax, depreciation and amortisation (EBITDA) ratio of 4.2 times, while other energy businesses were trading at more expensive valuations even though Santos' EBITDA is projected to grow by 22% between 2024 to 2027.

That compares to Woodside Energy Group Ltd (ASX: WDS) on a ratio of 4.6 times, Exxon Mobil on a ratio of 5.7 times and Chevron at 6.2 times. These three businesses are expected to see EBITDA decline between 2024 to 2027.