Wesfarmers Ltd (ASX: WES)'s retail chain Kmart has paid a $1,303,500 infringement notice after an investigation by the communications watchdog.

The Australian Communications and Media Authority (ACMA) revealed Thursday morning that it started its probe after complaints from consumers about Kmart spamming them.

The enquiry found the retailer sent 212,471 messages between July last year and May this year to customers who had already unsubscribed, which is in breach of spam laws.

Australians are "frustrated and angry" with brands not respecting their unsubscribe wishes, according to ACMA chair Nerida O'Loughlin.

"When a customer decides to opt out of a marketing mailing list, businesses are obliged to fulfil that request.

"The rules have been in place for nearly 20 years and there is simply no excuse."

O'Loughlin added that the Kmart case was especially disturbing because "it went on for such a significant period", even after ACMA notified it.

"Kmart was given more than enough notice [that] it may have a compliance issue, and it should have done more to address its problems before we had to step in and investigate."

Wesfarmers oversaw 'a combination of technology, system and procedural failures'

ACMA announced that the breaches occurred because of "a combination of technology, system and procedural failures".

According to Australia's spam rules, businesses must have consent from consumers to send them marketing material and unsubscribe requests must be actioned.

As well as the $1.3 million fine, Kmart has given a two-year court-enforceable undertaking that an independent consultant would review its spam compliance.

"Any business that conducts e-marketing should be actively and regularly reviewing its processes to ensure it is complying with the rules," said O'Loughlin.

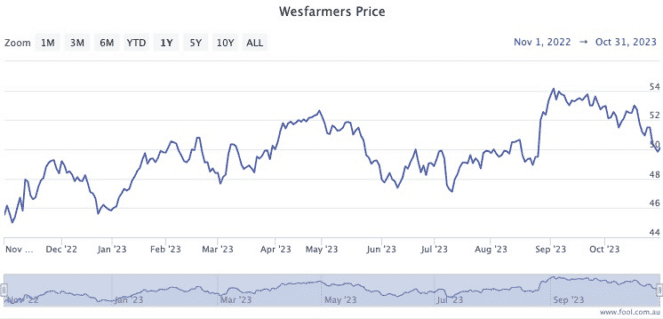

Wesfarmers shares are up 12.2% year to date, while paying out a dividend yield of 3.7%.

ACMA is on a tear with catching out spam breaches in recent times.

Other big names caught red-handed have included DoorDash Inc (NASDAQ: DASH), Ticketek, and Uber Technologies Inc (NYSE: UBER).