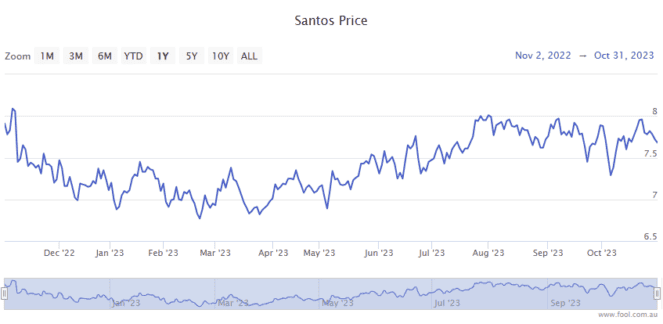

If you've been watching the charts, you may have noticed that the Santos Ltd (ASX: STO) share price took a rapid 2.6% tumble in afternoon trade.

Shares in the S&P/ASX 200 Index (ASX: XJO) oil and gas stock were trading almost flat at $7.73 before plunging to $7.52 apiece. At the time of writing, shares have regained some ground, trading for $7.53 which leaves the Santos share price down 2.71%.

Here's what's happening.

Santos share price battered by court ruling

On 24 October we reported on new potential headwinds facing the Santos share price amid a fresh legal challenge to the company's $5.7 billion Barossa Gas Project.

The project, located in the Timor Sea, is meant to supply Santos' LNG plant in Darwin, 200 kilometres away. Santos aims to have Barossa producing in the first half of 2025.

But the pipeline construction isn't sitting well with some Indigenous elders on the Tiwi Islands. They claim the undersea construction work could destroy ancient, culturally sensitive sites.

In a blow to the Santos share price, this afternoon the Federal Court suspended work on the pipeline project until 13 November. The court will hear arguments from the Tiwi Island plaintiffs before deciding whether to grant a full injunction.

Environmental Defenders Office lawyer Fiona Button is representing one of the plaintiffs, Simon Munkara.

Reading a statement from Munkara, Button told the court (quoted by The Australian Financial Review):

People lived on that land and there are burial grounds and other important things from our ancestors there, even though it has been a long time, and it's under the water, it was always our heritage, and it is all part of our beliefs.

On Tuesday (31 October), Santos released a statement saying that while the company "respects the cultural heritage of the Tiwi people" it would "vigorously defend" the Federal Court proceedings.

According to Santos:

The Environment Plan for the gas export pipeline installation was accepted by the regulator NOPSEMA in March 2020. Santos has, at all times, complied with the applicable regulations and requirements stipulated by NOPSEMA, and the regulator has monitored that compliance.

The ASX 200 energy company also said it rejected "allegations in the application that there are significant environmental impacts or risks in relation to submerged Tiwi cultural heritage".

If the court opts to grant a full injunction, it could have a material impact on the Santos share price.

According to the company, should that eventuate, "Santos will need to assess any impact on the schedule and cost of the Barossa Gas Project and will update the market accordingly."

Stay tuned.