Santos Ltd (ASX: STO) shares are marching higher on Tuesday.

Shares in the S&P/ASX 200 Index (ASX: XJO) oil and gas stock are up 1.1% at the time of writing, trading for $7.89 apiece.

For some context, the ASX 200 is up 0.1% at this same time.

Santos shares look to be shaking off concerns that the development of its $5.7 billion Barossa Gas Project faces a fresh hurdle amid claims from a group of Indigenous elders on the Tiwi Islands that the project risks destroying ancient, culturally sensitive sites.

Here's what's happening.

What's happening with the Barossa gas field?

Santos shares would likely face some stiff tailwinds if its Barossa project – located in the Timor Sea – were derailed when it could potentially start producing in the first half of 2025.

The gas from the offshore project is intended to supply Santos' LNG plant in Darwin, 200 kilometres away. The plant currently sources its gas from Santos' Bayu-Undan field.

While Baya-Undan continued to produce through the third quarter of 2023, Santos expects production from the site to end in the current quarter.

However, before production at Barossa can begin Santos needs to build the undersea pipeline to pump the gas to its Darwin plant.

NOPSEMA had delayed that plan, but Santos reported that it had notified the regulator in October of its intent to commence laying the pipe "after complying with the requirements of the General Direction issued by the regulator".

With pipeline construction imminent, six Tiwi Islanders have now petitioned Environment Minister Tanya Plibersek to halt the project. They are represented by Environmental Defenders Office lawyer Alina Leiken.

"This is a step our clients take very seriously, but given the importance of the cultural heritage at risk, it is a step they feel they must take," Leiken said (quoted by The Age).

Molly Munkara, one of the claimants, said, "If Santos puts that pipeline where it has said, it will destroy our sacred sites and our ancient burial grounds."

However, CEO Kevin Gallagher noted last week, "Over the last quarter Santos completed the First Nations underwater cultural heritage assessment required prior to pipelaying at Barossa."

In response to the direction previously issued by NOPSEMA, Gallagher said the independent expert concluded "there were no specific underwater cultural heritage places along the planned Barossa pipeline route that may be affected by the activities" of laying the pipeline.

Should the pipeline construction proceed as planned, Santos shares could still take a hit if the company can't gain approval for drilling work at Barossa.

Santos' approval for drilling was overturned in federal court last year on grounds the company hadn't properly consulted with Tiwi residents about its drill plans.

Commenting on the drilling operations, Gallagher said:

The Barossa drilling operations remain suspended with the drill rig on standby off the coast of Darwin as Santos works to secure the requisite approvals to recommence work.

Assuming that drilling re-commences before end 2023 and that the GEP commences installation in 2023, the Barossa project remains on target to commence production in the first half 2025 and within current cost guidance.

How have Santos shares been tracking?

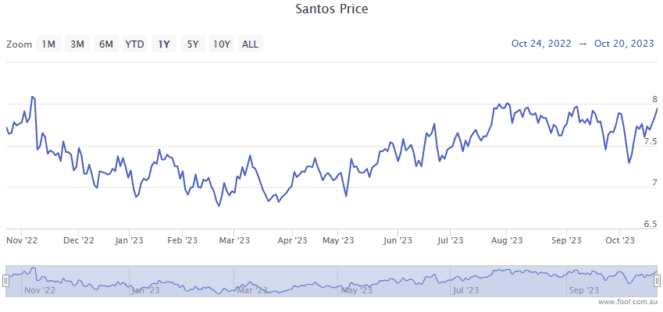

Santos shares have been strong performers in 2023, up 11%.