Brokers have named two ASX retail shares as buys which could be opportunities at the current prices. There is a lot of uncertainty in the air, though this can lead to the most attractive prices.

Experts are always on the lookout for ASX shares that are undervalued, and these two ideas could deliver good performance.

Let's get into it.

Temple & Webster Group Ltd (ASX: TPW)

This e-commerce business sells a wide variety of furniture, homewares and home improvement products.

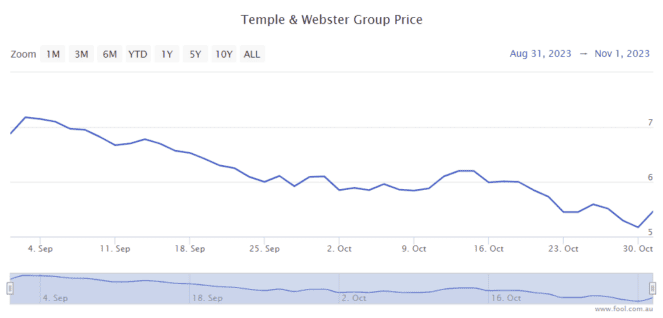

As we can see on the chart below, the Temple & Webster share price has fallen by close to 20% since 31 August 2023.

The broker Citi has rated Temple & Webster shares as a buy, with a price target of $6.50, according to reporting by The Australian. A price target is where the broker thinks that the share price will be in 12 months from now. Citi is suggesting that Temple & Webster shares could go up by 11% over the next year.

This business reported in FY23 that orders from repeat customers made up 54% of total orders, with revenue per active customer increasing by 6% year over year. In FY24 to 13 August 2023, its revenue had increased by another 16% thanks to both repeat and first-time customers.

The ASX retail share is expecting profit margins to rise as it becomes larger, and also benefit from the increasing adoption of technology across the business such as AI.

I agree that it's a long-term opportunity and I bought some shares a few days ago at $5.40 per share. I plan to write an article outlining my thoughts soon about this investment.

Adore Beauty Group Ltd (ASX: ABY)

Adore Beauty is an online retailer of beauty and health products. The Adore Beauty share price is down 40% from November 2022, as we can see on the chart below.

The broker Citi also called Adore Beauty shares a buy with a price target of $1.25, according to reporting by The Australian. That implies a possible rise of around 20% over the next 12 months from where it is today.

Over the past month, the Adore Beauty share price has risen 36% since I suggested it was "absurdly cheap".

The recent trading update was very positive for the ASX retail share considering all of the negativity surrounding the Adore Beauty share price.

Revenue in the first quarter of FY24 rose 4.7% to $47.5 million, while active customers increased 1.5% to 803,000 and returning customers increased 4.7% to 497,000.

More than a quarter of sales are through its app. It has launched an auto-delivery subscription service, new brands continue to be added to the platform and the company's private label brands keep growing.

It's on track to achieve an earnings before interest, tax, depreciation and amortisation (EBITDA) margin of between 2% to 4% in FY24.

Momentum now seems to be on the ASX share's side.