Earlier this week the S&P/ASX 200 Index (ASX: XJO) declined to a 12-month low as bond yields continued to fly high.

In such depressing times for the share market, the few stocks that are heading upwards stand out.

Swimming so competently against the tide must mean their underlying businesses are going absolutely gangbusters or have earnings drivers that are resilient to the troubles of the world.

Here's a couple of examples that Shaw and Partners portfolio manager James Gerrish is bullish on:

Winner winner chicken dinner

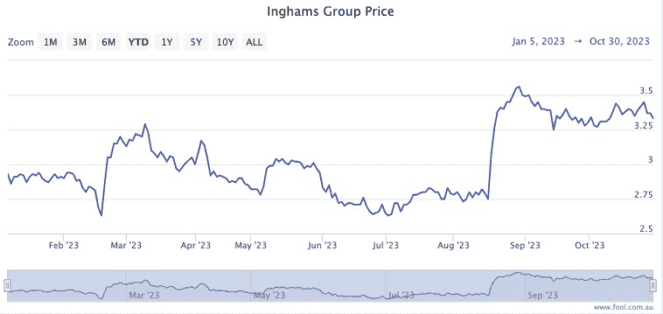

The Inghams Group Ltd (ASX: ING) share price has shot up more than 31% since the August reporting season.

The chicken producer could not care what the rest of the market is doing, rocketing up another 7.92% on Tuesday on the back of a business update.

"Investors have been buying this poultry producer's shares after it released a trading update and provided guidance for the first half," reported The Motley Fool's James Mickleboro.

"Management advised that it expects underlying net profit after tax to rise by 110% to $71 million."

Gerrish likes the tailwinds for Inghams with a consumer population traumatised by multiple cost-of-living pressures.

"History tells us that during tough economic times… we turn to the cheaper protein alternative of chicken over, say, steak. i.e. A likely tailwind through 2024," he said in Market Matters.

"We like the stock's resilience to market selling through September/October, and a push above $3.60 feels likely into Christmas, initially 5% to 10% higher."

Inghams pays out a fully franked 2% dividend yield.

'Risk/reward is now looking attractive'

Insurance broker AUB Group Ltd (ASX: AUB) saw its share price dip about 10% over September and October, but is rallying hard this week.

Even with that dip, the stock is still 21.7% up year to date, and 30.5% over the past 12 months.

Gerrish is a fan of the current discounted price around $27.

"The risk/reward is now looking attractive after its valuation has fallen to more justifiable levels," he said.

"All 9 of the analysts that cover this stock have it pegged as a buy with a target price over 25% higher – we wouldn't be surprised to see new 2023 highs if/when the market regains its mojo."

AUB shares are currently handing out a 2.4% dividend yield, fully franked.