The Inghams Group Ltd (ASX: ING) share price has jumped 6% higher after the poultry business gave an update to investors.

The update was for the half-year ending 23 December 2023 and revealed a number of positives for the company.

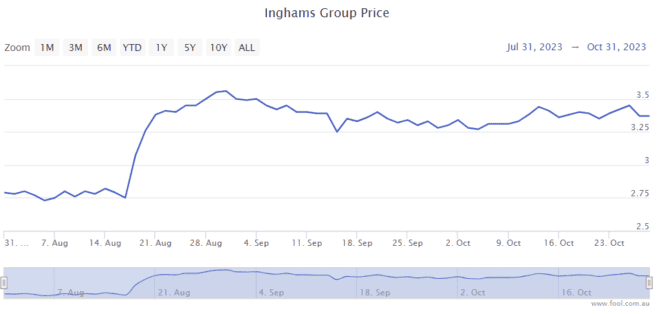

As we can see on the chart below, the Inghams share price had risen significantly in the three months before this update.

Trading update

The company has seen a recovery in operational performance across a "broad range of metrics" which has underpinned a positive start to FY24.

It's benefiting from a number of factors. First, there has been continued improvement in operational performance metrics across farming and processing.

Second, there is "strong demand" for poultry, with some customers allocating more shelf space to the category.

Third, there have been further improvements in wholesale pricing.

Finally, there has been an accelerated recovery in New Zealand.

Inghams share price rises amid earnings guidance

The business gave profitability guidance measures that show it expects a large increase in profit in the first half of FY24.

Before getting to the numbers, for readers who don't know, AASB16 is an accounting standard change that occurred in the last few years relating to leases. Some businesses still report the numbers showing what the number might have been without that accounting change.

In the first half of FY24, Inghams is guiding that pre-AASB16 underlying earnings before interest, tax, depreciation and amortisation (EBITDA) could grow by 65% to $138 million.

Pre-AASB16 underlying net profit after tax (NPAT) could rise by 110% to $71 million and statutory NPAT could jump by 278% to $65 million.

However, the company warned that the outlook remains dependent on several factors, including the continuation of the current level of wholesale pricing until the end of the FY24 first half and maintaining the current level of operational improvement.

It also warned that the FY24 second-half numbers are expected to be lower than the FY24 first half because of normal seasonality, and continued inflationary headwinds in labour, feed and other costs including fuel, electricity and CO2.

Inghams share price snapshot

Since the start of 2023, the Inghams share price has climbed 26%.