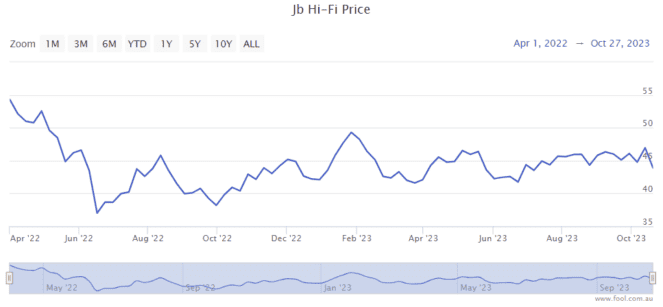

The JB Hi-Fi Limited (ASX: JBH) share price has fallen noticeably from its peak, down close to 20% from March 2022, as we can see in the chart below.

That's not the biggest decline in the ASX retail share sector over the last year or two, but it does present investors with an interesting opportunity.

While it's possible that the JB Hi-Fi share price could keep falling, I think that at this level it represents a long-term opportunity.

Resilient demand

I believe that JB Hi-Fi's revenue is more resilient than what some investors think.

Demand for TVs and drones may go up and down, but the company sells a large amount of products which could see ongoing demand even if the elevated cost of living hurts households. I think people will need to keep buying home appliances. Smartphones seem integral to a lot of people's lives, and laptops are necessary for work and so on.

Despite all of the economic headwinds that Aussies are facing, in a recent trading update for the first quarter of FY24, we saw that JB Hi-Fi Australia's total sales had only declined by 0.1% year over year, though The Good Guys had seen a decline of 12.2%. JB Hi-Fi New Zealand sales were actually up by 1% in the FY24 first quarter.

Considering the JB Hi-Fi share price has fallen, I think the valuation makes sense. According to the earnings estimate on Commsec, the JB Hi-Fi share price is valued at 13x FY24's estimated earnings.

Strong business model

There are four key competitive advantages that the business can point to, which give it an economic moat against competitors.

First, there is the company's scale which gives it buying power and other advantages.

Second, it has a low-cost operating model which enables strong margins and very productive sales floors.

The third competitive advantage that the company notes is its multichannel capability across stores, online, phone sales and so on. JB Hi-Fi tries to make it as easy as possible for customers to buy.

The final key advantage that the company highlights is its people and culture.

I think it's the business model and its competitive advantages that enable the company to perform well year after year, and why it's able to earn strong margins (for its industry).

Good dividends

JB Hi-Fi has paid lots of good dividends over the past decade. It increased its dividend every year from 2013 to 2022, which is a solid record considering that period included COVID-19.

According to the estimate on Commsec, the company is projected to pay an annual dividend per share of $2.23 in FY24. At the current JB Hi-Fi share price, that would equate to a grossed-up dividend yield of 7.1%.

Considering this dividend is the projection for what could be a weak year for retail, it's a solid starting yield, in my opinion.