An important date that owners of National Australia Bank Ltd (ASX: NAB) shares need to know is the reporting date of the annual result. This is when shareholders get the most information about how the ASX bank share is performing and its financial trends.

NAB is scheduled to hand in its full-year result on 9 November 2023. It could make for an interesting day for NAB shares. Comments and details within the report can influence what investors think of the business for the foreseeable future.

FY23 expectations for profit

There are various estimates for what the bank might achieve in its upcoming results.

Looking at the forecast on Commsec, NAB is projected to generate earnings per share (EPS) of $2.48. That would put the NAB share price at just over 11x FY23's estimated earnings.

The broker UBS has predicted that NAB will generate net earnings of $7.74 billion in FY23, with EPS of $2.29. That would put the NAB share price at 12x FY23's estimated earnings.

UBS is cautious about "possible higher credit provision charges for NAB given its more business banking focused loan/earnings mix". The broker currently has a sell rating on the ASX bank share because of its "richer valuation to peers and overall business mix at this point in the interest rate and credit cycle."

At the time of its investment call, UBS said NAB traded at an approximate 20% premium valuation to two of the other major banks. This reflected "strong operational/financial momentum over the past few years and the market's qualitative assessment of management, and NAB's franchise strength."

However, in UBS' view, NAB is likely to be the "most exposed to a deteriorating credit cycle compared to peers". The bank also had a "weaker relative funding mix given lower retail deposit market share". The broker thinks this is negative for the net interest margin (NIM).

What dividend could owners of NAB shares get?

According to Commsec's projection, the bank could pay an annual dividend per share of $1.67. This would represent a grossed-up dividend yield of 8.4%.

With the fact that NAB has already paid a half-year dividend of 83 cents per share, the projection implies the ASX bank share could pay an FY23 final dividend of 84 cents per share. The final dividend per share would represent a grossed-up dividend yield of 4.2%.

Forecasts can change, but the current projection on Commsec is that NAB's dividend per share could be $1.68 in FY24 and $1.70 per share in FY25.

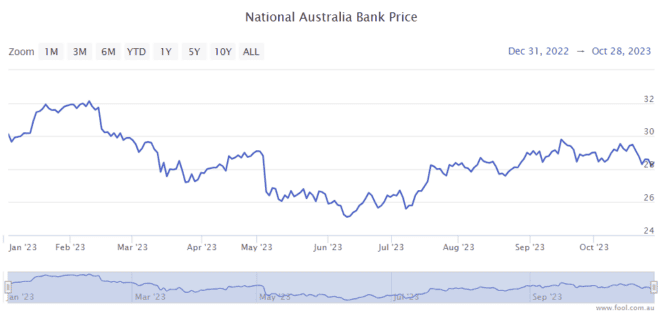

NAB share price snapshot

Since the start of 2023, NAB shares have fallen more than 3%, as we can see in the chart below. That compares to a fall of 1.7% for the S&P/ASX 200 Index (ASX: XJO) over the same time period.