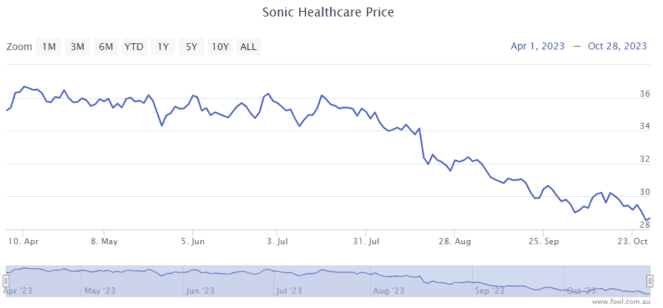

The Sonic Healthcare Ltd (ASX: SHL) share price has dropped around 20% over the past six months, as we can see in the chart below. I think that is just one reason why the S&P/ASX 200 Index (ASX: XJO) healthcare share is an investment opportunity.

Sonic provides pathology services in countries including the United States, Australia, Germany, the United Kingdom, Switzerland, Belgium and New Zealand.

Here are the three reasons why I think it's a good buying opportunity.

Better valuation

Simply, when a quality company with a compelling long-term future goes down in price, it becomes better value, in my opinion.

The Sonic Healthcare share price fall of 21% from 12 April 2023 has made a significant difference to the price/earnings (P/E) ratio.

According to Commsec, the company is projected to generate earnings per share (EPS) of $1.40 in FY24 and $1.61 in FY25. This puts the current Sonic Healthcare share price at 21x FY24's estimated earnings and 18x FY25's estimated earnings.

Solid dividends

Sonic Healthcare has increased its dividend to shareholders most years over the past two decades.

The board of directors has a "progressive dividend policy". This means the intention is to increase the payment to shareholders each year, assuming business conditions allow it to. Don't forget that a dividend (increase) isn't guaranteed, though.

Using the last 12 months of dividends paid, Sonic Healthcare's trailing fully franked dividend yield is 3.7%, or 5.3% grossed-up.

I think it's quite reassuring to know that this ASX 200 healthcare share is likely to pay a solid dividend — and likely a bigger payment. So we're not totally reliant on the share price going up for a positive result.

Compelling outlook for long-term earnings growth

COVID-19 testing earnings are fading away, but the underlying business continues to perform well. In FY23, its base business revenue rose by 11%.

In FY24, the ASX 200 healthcare share expects earnings before interest, tax, depreciation and amortisation (EBITDA) to rise by 5%, though the interest cost is also expected to increase.

There are a number of tailwinds that could help earnings grow in the future. These include ageing demographics, growing populations in its main markets and increasing use of technology such as artificial intelligence (AI) which may boost margins and patient service.

I also like how the business is utilising excess capital to make acquisitions in markets such as Europe. Greater scale can help with margins and enable better net profit and dividends in the coming years.