The Fortescue Metals Group Ltd (ASX: FMG) share price is charging higher today.

Shares in the S&P/ASX 200 Index (ASX: XJO) iron ore miner closed yesterday trading for $21.35. At the time of writing on Wednesday, shares are changing hands for $21.88, up 2.5%. In earlier trade, shares were up as much as 3.2%.

That sees the Fortescue share price handily outperforming the benchmark today, with the ASX 200 up 0.3% at this same time.

Here's what's driving investor interest today.

What's boosting the ASX 200 miner?

With no fresh price-sensitive news out today, the Fortescue share price looks to be riding the tide higher alongside most other top tier miners.

The BHP Group Ltd (ASX: BHP) share price, for example, is up 2.6% at the time of writing. And the Rio Tinto Ltd (ASX: RIO) share price is joining the mining rally, up 2.2%.

This sees the S&P/ASX 200 Resource Index (ASX: XJR) up a very solid 1.3% in morning trade.

Some of the tailwinds look to be blowing out of China, Australia's top iron ore export market. With the Chinese economy still struggling to regain solid growth traction, President Xi Jinping has announced increased stimulus measures for the world's number two economy, with more sovereign debt to be issued.

On the back of that news, the iron ore price is up 2.9% overnight, trading for US$116.05 per tonne. The industrial metal – Fortescue's top revenue earner– continues to defy a series of bullish forecasts issued in the third quarter, which saw analysts predicting it to fall below US$100 per tonne in Q4.

The Fortescue share price – alongside Rio Tinto and BHP shares – also could be enjoying a broader lift in investor sentiment for the mining sector. That lift follows news Prime Minister Anthony Albanese has committed to doubling the government's subsidies for critical minerals exploration and production to $4 billion.

Fortescue share price snapshot

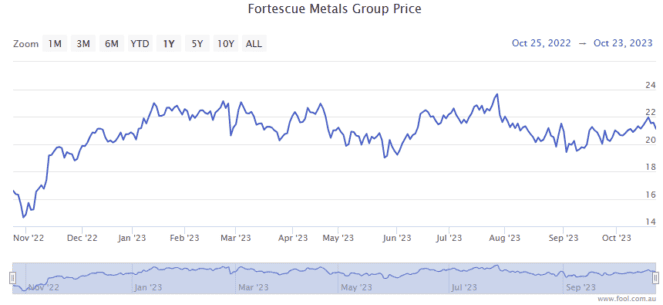

With today's intraday boost factored in, the Fortescue share price is up 34% in 12 months.