If you're on the east coast of Australia, you might remember 2022 was the year when it just wouldn't stop raining.

The backyard was permanently soaked and parts of Victoria, NSW and Queensland even experienced devastating floods.

That was all thanks to the oceanic phenomenon of La Nina.

Now, in 2023, meteorologists have declared that her counterpart El Nino has arrived.

That will mean that eastern Australia is more likely to experience drier-than-normal conditions for the foreseeable future.

But you're reading The Motley Fool, so you're wondering what weather patterns have to do with S&P/ASX 200 Index (ASX: XJO) shares.

Well, believe it or not, the team at Wilsons Advisory reckons they've found the perfect stock to buy for El Nino.

The sector that's sitting pretty in 2023

Wilsons analyst Greg Burke, in a memo to clients, argued that conditions have never been better for the insurance industry.

As an essential service, insurance providers have been able to raise premiums this year in line with inflation without worrying too much about losing customers.

And the current anxiety in the economy is also a boon.

"An improved outlook for future investment returns given recent strength in bond yields," said Burke.

"Insurance should be relatively resilient through a consumer slowdown."

Finally, after a shocking 2022 when claims from water-related damage were coming in thick and fast, the sector is welcoming dry conditions associated with El Nino.

"The prospect of claims cost pressures [are] easing after a tough period for natural perils."

Which ASX shares are the best bet in insurance?

Among the ASX 200 insurers, Burke's pick is Insurance Australia Group Ltd (ASX: IAG), which Wilsons already holds in its focus portfolio.

"IAG is poised to deliver the strongest earnings per share (EPS) growth over the next 3 to 5 years out of the ASX listed general insurers, with risks skewed to the upside (vs consensus), in our view."

And it is flush with money to return to shareholders.

"IAG is the only ASX-listed general insurer currently conducting capital management activities — it is currently ~35% of the way through its $350 million on-market buyback," Burke said.

"There is scope for further capital management over the medium term, given IAG's strong balance sheet, improving profitability, and considering the likelihood (in our view) of further Business Interruption (BI) provision releases (provision is currently ~$400 million), following favourable court rulings."

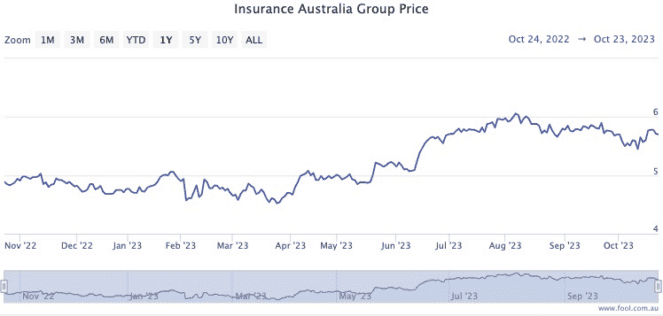

So far this year the IAG share price has risen more than 22%.

However, with the stock still 34% lower than its pre-COVID peak, Burke says the stock has an "undemanding valuation".

"IAG's forward price to book ratio, at ~1.9x, sits below its 10-year average of ~2.1x, which we view as undemanding considering the strong cyclical tailwinds and IAG's medium-term earnings trajectory."