For those investors that want to put their money into lithium, they have two choices.

Either they can buy ASX lithium stocks for companies that are already large producers, or they can invest in smaller, more speculative, miners.

The latter path can seem attractive because of the potential for a massive windfall. After all, some investors have become overnight millionaires from exploration businesses turning into actual producers.

But choosing the large producer route is the far less risky proposition.

This is especially so for a commodity like lithium, whose value is riding a structural theme like the global transition to net zero.

So if you're interested in this strategy, take a look at this investment case for one major lithium producer:

'Every part of the business will grow substantially'

Mineral Resources Ltd (ASX: MIN) produces all sorts of different minerals, but the team at Auscap knows which one it likes.

"Mineral Resources' lithium business remains the most attractive part of the investment proposition to us, given the strong global momentum that continues behind the transition to electric vehicles," it stated in a memo to clients.

And a recent tour of mine sites in Western Australia opened Auscap analysts' eyes.

"It strongly reinforced for us the multitude of organic growth options at the company's disposal, many of which are already in the process of being executed.

"Over the next two years, it is likely that every part of the business will grow substantially."

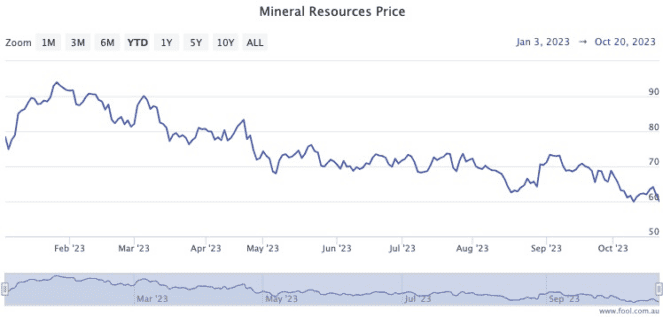

The MinRes share price has dropped more than 41% since late January.

But the Auscap team urged investors to look past this dip, as volatility in commodity markets means it's not unusual to see wild swings in the stock price in the short term.

"But the ability of the company to identify and execute on high-returning growth projects has been consistently impressive for its 15+ year life as a listed company," read the memo.

"We continue to back this quality growth to continue."

This lithium stock has strong support

The $11 billion miner has many other fans among professional investors.

According to CMC Markets, 10 out of 17 analysts currently rate Mineral Resources as a strong buy.

Earlier this month, the Citigroup Inc (NYSE: C) equities team also saw value in the current dip in the MinRes share price.

"We may be too early on our buy call with consensus downgrades still to come for the September quarter onwards and battery restocking unlikely until post Chinese New Year," said Citi market analyst Kate McCutcheon.

"But [lithium] names have pulled back about 30% over the past three months and on balance there's value here with producers on 0.7 times price to net asset value."