Sometimes excellent companies present eye-opening buy-the-dip opportunities.

That's because share prices are a reflection of market sentiment — which includes fear and greed — not necessarily business performance.

Humans act irrationally, including stock investors.

So here is a pair of ASX shares shunned by the market in recent weeks that experts are tipping as golden buying opportunities right now:

The lithium miner that will 'deliver'

If you ever wanted to get a piece of the lithium action, this could be your chance.

That's because global prices for the mineral are down this year due to weak Chinese demand, and consequently weakening the valuations of lithium miners. However, many analysts reckon in the long run, the world will only want more of the good stuff for a low-carbon future.

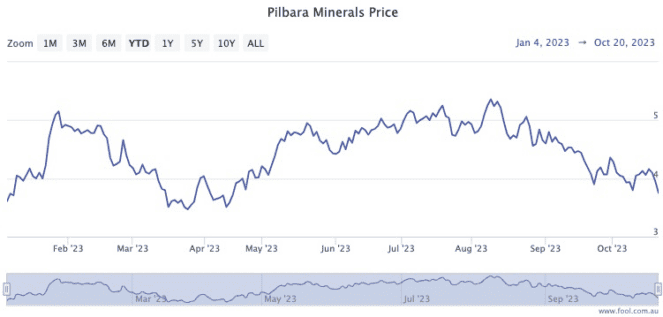

One of the bigger producers, Pilbara Minerals Ltd (ASX: PLS), has seen its stock price plunge more than 28% since 10 August.

Medallion Financial Group director Philippe Bui reckons Pilbara will end up an outstanding investment once lithium prices normalise.

"Pilbara is trading on an undemanding price/earnings ratio," Bui told The Bull.

"The company aims to produce a million tonnes by the end of 2025, a significant increase on existing production."

Pilbara Minerals also has plenty of money in the bank while paying a fully franked 6.5% dividend yield.

"The company paid a fully franked full-year dividend of 25 cents a share in fiscal year 2023," said Bui.

"The lithium company had $3.3 billion of cash on its balance sheet when announcing its full-year results… Provided lithium prices settle in what has been a recent downturn, Pilbara should be able to deliver."

Time to buy the dip on a much-discussed ASX stock

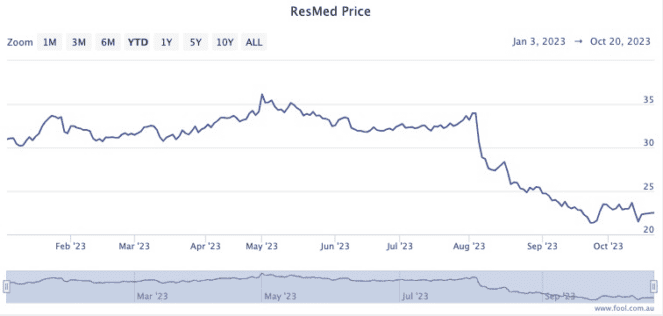

Resmed CDI (ASX: RMD) is a contender for most-discussed ASX stock over the past few weeks, as the healthcare share has lost one-third of its value since early August.

Red Leaf Securities chief John Athanasiou noted that the rise of new drugs like Ozempic is striking fear into investors.

"ResMed makes medical devices to treat sleep-disordered breathing.

"RedMed has been oversold on investor concerns that diabetes and obesity medicines will impact future sales of the company's sleep apnoea products."

However, both he and Bui reckon investors with long horizons need not worry.

"We believe these concerns are overblown," said Athanasiou.

"The cheaper share price provides an opportunity to invest in a blue chip company that offers long-term growth prospects."

Bui admitted one metric was weak in the August financial report, but the temptation to buy the dip is too great now.

"Margins were slightly softer than expected in the company's last quarterly results. From a long-term perspective, we see the recent pullback as an attractive entry point."