The Paladin Energy Ltd (ASX: PDN) share price is well into the green on Friday, while the S&P/ASX 200 Index (ASX: XJO) remains down 1.4%.

Shares in the ASX 200 uranium stock closed yesterday trading for 94.5 cents. At the time of writing, shares are swapping hands for 96 cents apiece, up 1.6%.

This outperformance comes following the release of the company's quarterly update for the three months ending 30 September.

Here are the highlights.

What did the ASX 200 uranium miner report?

The Paladin Energy share price is marching higher today as ASX 200 investors eye the imminent reopening of the company's Langer Heinrich Mine, located in Namibia.

Paladin reported that the project is now around 80% complete, with commissioning having commenced.

Investors will also be pleased to hear that the project remains on track – and within its budget of US$118 million – to achieve first production in the first quarter of 2024.

Leading African mining contractor, Trollope Mining Namibia has been appointed for the stockpile reclaim phase of operations at the project.

On the financing front, Paladin has appointed Nedbank Limited as the mandated lead arranger for a proposed syndicated debt facility.

Commenting on that appointment Paladin Energy CEO, Ian Purdy said:

With our strong uranium contract book and world class asset in the Langer Heinrich Mine we are well positioned to engage with Nedbank on a syndicated debt facility to provide flexibility as we recommence operations.

Looking ahead, Purdy added, "With increasing awareness of nuclear energy as a low carbon energy source, Paladin remains well positioned to deliver long term sustainable value for our stakeholders."

The Paladin Energy share price also looks to be getting some tailwinds out of North America, where the miner has taken 100% ownership of the Michelin Project, located in Canada. The company has been granted mineral licences for prospective new ground adjoining the project, with exclusive rights to explore those tenements.

As at 30 September, the company had just under $100 million in unrestricted cash holdings.

Paladin Energy share price snapshot

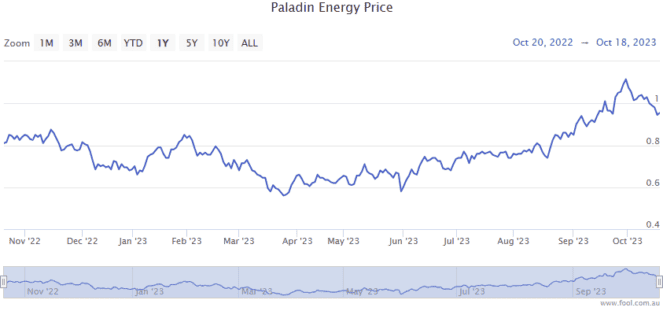

The Paladin Energy share price has been a strong performer in 2023, up 45%.