The Northern Star Resources Ltd (ASX: NST) share price is shrugging off the wider market malaise today to charge higher.

Shares in the S&P/ASX 200 Index (ASX: XJO) gold miner closed yesterday trading for $11.48. At the time of writing on Thursday morning, shares are swapping hands for $11.86 apiece, up 3.3%.

For some context, the ASX 200 is down 1.2% at this same time.

The strong performance comes following the release of Northern Star's quarterly update for the three months ending 30 September.

What's boosting the Northern Star share price today?

The Northern Star share price is marching higher after the company reported total gold sales for the quarter of 369,000 ounces. That's down from 426,000 ounces in the prior quarter, largely due to planned shutdowns at its three production centres.

The gold was produced for an all in sustaining cost (AISC) of AU$1,939 per ounce (US$1,260/oz).

Over the three months, the gold was sold for an average sales price of AU$2,815/oz, achieving gold sales revenue of AU$1.04 billion.

Northern Star's total hedging commitments comprise 1.68 million ounces at an average price of AU$2,929/oz. During the September quarter, 330,000 ounces of hedging was added at AU$3,314/oz. 125,000 of hedging was delivered at AU$2,544/oz.

The ASX 200 gold miner generated underlying free cash flow of AU$28 million during the quarter.

As for the balance sheet, Northern Star held AU$1.2 billion of cash and bullion as at 30 September, with AU$2.2 billion of liquidity.

The ASX 200 gold miner said its AU$300 million on-market share buyback program will be "used opportunistically", with AU$131 million of that buyback remaining.

What's next?

Looking to what could impact the Northern Star share price in the months ahead, the miner maintained its FY 2024 guidance of 1.6 million to 1.75 million ounces of gold sold at an AISC of AU$1,730-1,790/oz. The company noted this is weighted towards second-half production spurred by increased production at Thunderbox, higher ore volumes and grade at KCGM and continuous grade improvement at Pogo.

On the capital expenditure front (sustaining, growth and exploration), Northern Star expects FY 2024 capex to be in line with FY 2023. That excludes AU$525 million for its KCGM Mill Expansion.

What did management say?

Commenting on the results sending the Northern Star share price sharply higher today, managing director Stuart Tonkin said:

During the quarter we safely and successfully completed major planned shutdowns at our three production centres. This provides a clear pathway for the Company to achieve its full-year guidance, which as previously flagged is 2H weighted…

Northern Star generated solid quarterly underlying free cash flow from our operations as our recently expanded production centres – Yandal and Pogo – offset KCGM, where we have begun Mill Expansion capital works. Our focus remains steadfast on operational excellence to maximise free cash generation.

Northern Star share price snapshot

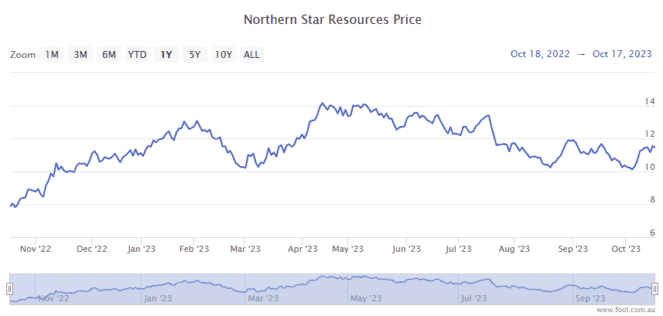

The Northern Star share price has been a star performer over the past 12 months, up 46%.