It might be counterintuitive, but it's entirely possible that you can be simultaneously bullish for one stock that's plunged and another that's rocketed within the same month.

That's because long-term investors will look past share price movements in any particular month. They only care that the investment trends upwards over a matter of years.

The other important factor for growth shares, especially, is that the Reserve Bank of Australia may not have to increase interest rates that many more times.

While inflation remains high, it has come down from its peak and the effects of 12 rate rises over 14 months is still cascading out through the economy.

In that spirit, let's take a look at three growth shares that went in all different directions in September, but nevertheless the analysts at ECP are all bullish on right now:

'Customer value proposition remains compelling'

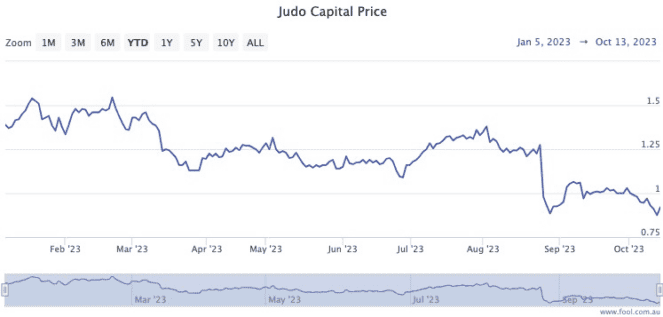

Small business lender Judo Capital Holdings Ltd (ASX: JDO) enjoyed a 8.7% rise in its share price last month.

The stock had previously declined in reporting season because of disappointing net interest margin (NIM) numbers, which is a crucial statistic for lending businesses.

"The market was not expecting the degree of decline in the NIM, driven primarily by a more expensive funding mix as the TFF is refinanced," stated the ECP team in a memo to clients.

But investors are now looking past that hump and are realising the business is expanding at a rapid rate.

"Judo is growing its loan book quickly and its customer value proposition remains compelling," read the memo.

"While there is some risk around achieving its metrics at scale, we remain positive on its competitive position in the market, its ability to take market share and its asset quality."

'Strong fundamentals'

Meanwhile the Hub24 Ltd (ASX: HUB) share price remained reasonably flat during September, ending the month 0.68% higher than where it started.

"Hub24 continues to show strong fundamentals and the market has shrugged off some of the concerns it harboured earlier in the year regarding flow momentum, which the company flagged has re-accelerated in the new financial year."

Indeed if we go back longer, the stock price has rocketed an impressive 50% over the past 12 months.

"With attractive margins and operating leverage incrementally flowing through, the outlook remains compelling for Hub24."

Hub24, as an investment platform, will likely benefit as interest rates stabilise, as investor sentiment will become more favourable.

'New customer additions' and 'increasing monetisation of users'

US payment technology giant Block Inc CDI (ASX: SQ2) has had a torrid time since the massacre of growth shares started in early 2022.

Not only did the share price dive a hair-raising 23% in September, the stock has now lost its investors more than 61% since the start of April last year.

Yikes.

"Block Inc underperformed during [last] month following the announcement that Aylssa Henry, Square Seller CEO, is leaving and that Jack Dorsey will take over her role," read the ECP memo.

"In addition, the resumption of US student loan payments in October following a COVID freeze is also likely weighing on the stock."

Nevertheless, ECP analysts are keeping the faith for the long run.

"We remain attracted to Block's structural growth drivers being new customer additions to both Square and Cash App as well as increasing monetisation of users."

Although it is of reasonable size already, Block plays in a crowded space where it needs to keep taking market share.

Therefore any pause in rate rises will see more positive investor feelings towards the business.