Metcash Ltd (ASX: MTS) is one of my favourite S&P/ASX 200 Index (ASX: XJO) share picks for its large dividend yield.

A dividend yield is dictated by two things – the dividend payout ratio and the price/earnings (P/E) ratio. In other words, how much profit a company pays to shareholders and what multiple of earnings the share price is trading at.

If it pays out most or all of its profit, then the dividend yield is given a good boost. Trading on a low valuation is also helpful for the dividend yield.

What is Metcash?

Metcash is a diversified business that acts as a distributor for a variety of different independent businesses, with IGA supermarkets around Australia being the key supply relationship.

It also supplies a number of independent liquor retailers. These include Cellarbrations, The Bottle-O, IGA Liquor, Thirsty Camel, Big Bargain Bottleshop Duncans and Porters Liquor.

For me, the most exciting thing about the business is its hardware division. It owns three key brands – Mitre 10, Home Timber & Hardware and Total Tools. It also supports independent operators under small format convenience banners called Thrifty-Link Hardware and True Value Hardware, as well as a number of unbannered independent operators.

ASX 200 share's payout commitment

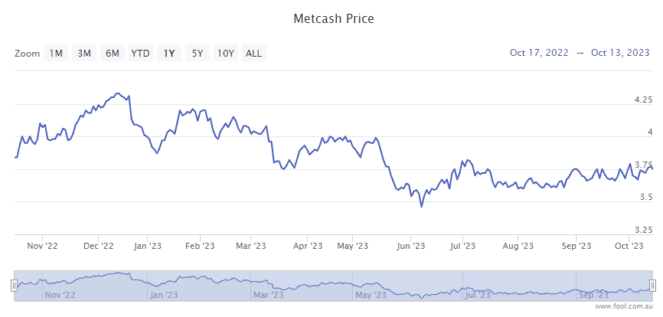

The company aims to pay 70% of its underlying net profit after tax (NPAT) to shareholders. In FY23, this led to a Metcash dividend per share of 22.5 cents per share, which at the current valuation equates to a cash dividend yield of 5.9% and a grossed-up dividend yield of 8.4%.

This dividend came after the company managed to grow its underlying earnings per share (EPS) by 6.4% to 31.8 cents.

How big could the Metcash dividend be in FY24?

When the dividend is decided by a payout ratio, the ASX 200 share's profit generation figure is key.

The projection, which is just a calculated guess, suggests that Metcash could generate EPS of 30 cents in FY24. That would put Metcash shares at 13x FY24's estimated earnings. With that profit, it could pay an annual dividend per share of 21.2 cents.

Even if there's an economic downturn in FY24, I think Metcash's operations are defensive enough to keep generating good profit. People still need to eat food, people will keep going to liquor stores, and with Australia's growing (and wealthy) population, I think the hardware division will keep delivering good earnings.

The forecast FY24 payout would represent a cash yield of 5.6% and a grossed-up dividend yield of 8%.

I think there's a fair chance that the FY24 dividend could increase because FY24 has started well. In the first 18 weeks, total sales were up 1.7%, and total hardware sales were up 3.2%.

Hardware sales are typically more profitable than food sales, so it's helpful for the ASX 200 share's profit that hardware is performing.

Commsec projections suggest that Metcash could pay another grossed-up dividend yield of around 8% in FY25, so the next couple of years could be rewarding.