Does your portfolio hold the same old ASX shares that everyone else has?

If so, why bother?

You might as well just buy an ASX index fund and be done with it. Why give yourself all the work of forming a balanced portfolio and tracing company performance?

The reason why many people prefer investing in individual stocks over a passive fund is to try to harvest better returns than the index.

So if that's what drives you, you better start considering stocks that other people haven't thought about.

That's called active investing, and it's mathematically the only chance of performing better than the index.

So, keeping this in mind, let's check out a couple of tips from Glenmore Asset Management portfolio manager Robert Gregory, who is known for hunting down those hidden gems:

'A key revenue driver' going gangbusters

MMA Offshore Ltd (ASX: MRM) is not a household name, and it provides very niche services.

The company provides boats, ships and other marine equipment for clients operating facilities like offshore oil and gas rigs.

The MMA share price rose 4.5% last month, Gregory noted in a memo to clients.

"Early in the month, MMA Offshore announced its platform supply vessel, MMA Inscription, was awarded two contracts to provide LNG field support duties in Australia's Northwest.

"Revenue is expected to be ~$12 million with potential for an additional $4.9 million."

While the monetary amount of the contracts was not massive, for Gregory it was an affirmation of its business model.

"We continue to believe the outlook for day rates — a key revenue driver — for MMA Offshore's vessels is very positive."

Despite the wins, these ASX shares are still largely flying under the radar.

But the two analysts that do cover it, according to CMC Markets, both concur with Gregory's bullishness. Canaccord and Euroz are both rating MMA Offshore as a strong buy.

The ASX shares invested for the social good

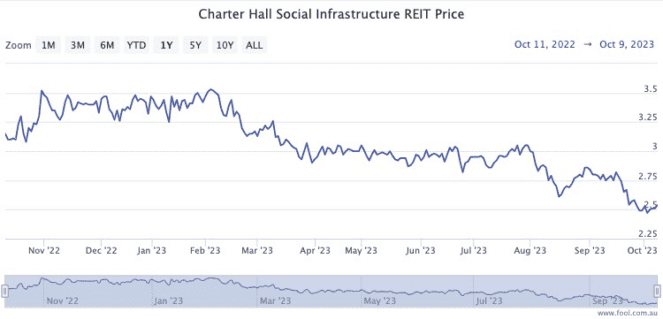

Charter Hall is a familiar brand on the ASX, but out of the four stocks with that label, Charter Hall Social Infrastructure REIT (ASX: CQE) is arguably the least discussed.

That real estate investment trust (REIT) invests in "social infrastructure properties", which lease to tenants like childcare centres, healthcare clinics, and emergency command centres.

The stock unfortunately dropped 11.3% last month, which Gregory attributed to the market conditions.

"In line with the broader property trust sector on the ASX, CQE fell due to the rise in bond yields in September," he said.

"Higher bond yields impact these stocks by making their distribution yields relatively less attractive."

Gregory feels like these ASX shares are heavily discounted but, in the long run, could catch up to what it's truly worth.

"Despite the current headwinds in the form of high inflation and rising bond yields, CQE trades at a very significant discount (~35%) to its net tangible assets (NTA) per share of $4.04."

Charter Hall Social Infrastructure shares closed flat on Thursday at $2.65.

To soothe the lagging share price in the short term, investors are currently paid a 6.5% dividend yield.

CMC Markets is currently showing four out of six analysts recommending the real estate stock as a buy.