One of the biggest potential reasons for massive price movement in an ASX stock is mergers and acquisitions.

That's because, in an instant, the nature of the whole business can change.

If it's offloading an unprofitable activity, then the company can then concentrate on what it's good at. If it's bringing in a new business then it can immediately bring new products, customers and revenue.

So with that in mind, here are two ASX shares that the analyst at QV Equities are waiting with bated breath for corporate shenanigans:

The merger deal that could reduce debt and return capital to shareholders

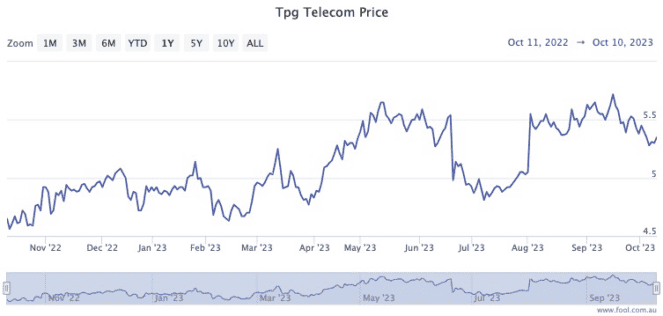

TPG Telecom Ltd (ASX: TPG) shares seem like a perennial underachiever, but they've been going well in recent weeks.

"TPG Telecom (TPG) was up +14% after reporting a solid first half result and announcing it is in discussions with Vocus to divest its Enterprise, Government and Wholesale business at a valuation higher than the current share price implies," QVE analysts said in a memo to clients.

They are pinning their hopes on this deal coming to fruition, as it would put a further rocket under TPG shares.

"If there is a sale it would enable TPG to reduce debt, and potentially return capital to shareholders while focusing on its resilient and growing consumer business."

Last month, the Wilson Asset Management team was also bullish on TPG due to this potential transaction.

"The upgraded FY23 EBITDA guidance was pleasing and we look forward to receiving further updates around the proposed transaction in the coming months which may provide a further catalyst for a share price re-rating," it said in a note to its clients.

A bargain buy

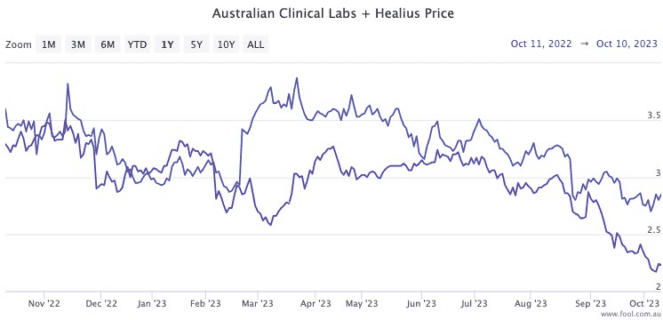

Australian Clinical Labs Ltd (ASX: ACL) has been a poor investment even for long-term investors, with the stock now trading around 31% lower than its initial public offering (IPO) price.

Even last month, investors could only watch in horror.

"Australian Clinical Labs disappointingly declined -15% after reporting at its full year result that the recovery in underlying volumes are taking longer to recover to pre-COVID levels than anticipated," said the QVE team.

"The fall in COVID-related revenues will result in little earnings growth in FY2024."

However, it does currently pay out a nice fully franked 5% dividend yield and has a transformative deal awaiting regulatory approval.

"ACL's proposed merger with pathology peer Healius Ltd (ASX: HLS) remains under consideration by the ACCC, if it goes ahead it will deliver significant synergies."

In fact, the QVE team took advantage of the recent stock price weakness.

"We increased our position in ACL, as we think its longer-term prospects look strong."