Whitehaven Coal Ltd (ASX: WHC) shares have waned on Thursday as one shareholder takes matters into their own hands.

One of Australia's largest coal mining companies is now squarely in the sights of a fierce campaign to vote down Whitehaven's remuneration report. Surprisingly, it is none other than one of the company's own shareholders scalding the coal miner and its management.

As we slip past the close today, Whitehaven shares have limped 1.19% lower to $6.67.

Not a happy shareholder

Hailing from London, Bell Rock Capital is a hedge fund holding somewhere in the vicinity of $280 million worth of Whitehaven shares. While the position equates to a little less than a 5% stake in Whitehaven, Bell Rock is going big with an effort to change the executive pay structure.

Warren Buffett's right-hand man and Berkshire Hathaway's vice chair, Charlie Munger, once said, "Show me the incentive, and I'll show you the outcome."

It seems Bell Rock Capital took note of that one.

The hedge fund is highly critical of Whitehaven Coal's remuneration report, asking shareholders to join in voting against it at the upcoming annual general meeting.

According to Bell Rock, the proposed remuneration and incentives are not aligned with shareholders. Namely, the removal of total shareholder returns as a performance measure for the company's management.

The change would mean executives "could destroy the share price, cancel or reduce dividends, stop the share buyback, and still pay a healthy bonus to management", in the words of Bell Rock's Mike O'Mara.

It would be the first pay structure without total shareholder returns as a measurement of success since 2011.

Instead, Whitehaven has steered its bonus conditions more in favour of run-of-mine production and earnings before interest, taxes, depreciation, and amortisation (EBITDA) — increasing the weighting to these by 20% and 25%, respectively.

The newly weighted conditions lend themselves to making acquisitions and growing the top line. However, Bell Rock Capital is concerned that these can quite easily destroy shareholder value in the process.

As it turns out, Whitehaven is already in hot pursuit of BHP Group Ltd (ASX: BHP) Duania and Blackwater coal mines.

Furthermore, the hedge fund questions Whitehaven CEO Paul Flynn receiving a salary three times the average of his peers. According to the letter, the premium seems difficult to justify given the relatively poor performance of Whitehaven shares versus other ASX coal companies.

How have Whitehaven shares performed against its peers?

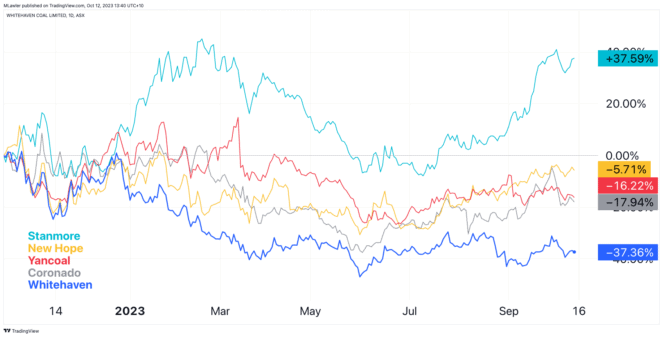

In the last 12 months, the Whitehaven share price has drastically underperformed fellow ASX-listed coal miners. After delivering a record profit at the end of 2022, Whitehaven has witnessed its share price tumble.

In contrast, Stanmore Resources Ltd (ASX: SMR) has seen its share price perform strongly over the past year, gaining 37.6%, as shown above.

Meanwhile, a handful of other ASX coal miners have landed somewhere in between.