Liontown Resources Ltd (ASX: LTR) shares are trading even at $2.96 apiece at the time of writing.

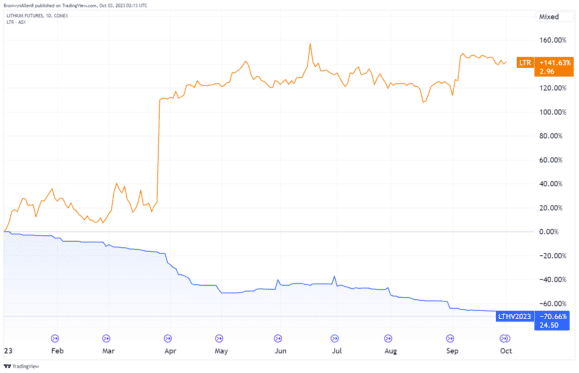

The ASX lithium share is enjoying a stellar run in 2023, with the share price up by more than 140% so far.

This is despite a significant decline in lithium prices this year, as shown in the chart below, and a poorer medium-term outlook for the commodity.

What's the latest news with this ASX lithium share?

In early September, US lithium giant Albemarle Corp (NYSE: ALB) took another stab at acquiring the junior miner.

Albemarle offered a conditional and non-binding indicative offer to acquire all Liontown shares for $3 in cash per share via a scheme of arrangement.

This bettered the previous offer of $2.50 per share, which was rejected by the Liontown board.

The new offer valued Liontown shares at $6.6 billion at the time.

The board liked the offer enough to give Albemarle access to conduct a limited period of exclusive due diligence. This may lead to Albemarle upgrading its offer to a binding proposal.

The board intends to recommend a binding proposal at $3 per share.

This due diligence is likely to conclude in late October or thereabouts.

A week after Liontown announced Albemarle's revised offer, the company issued an initial substantial shareholder notice revealing Australia's richest woman, Gina Rinehart of Hancock Prospecting, had raised her stake in the company to above the 5% threshold to become a substantial holder.

Rinehart had been buying Liontown shares since April and reached a 7.72% stake on 12 September.

But she didn't stop there.

By the end of the month, she held a 12.36% position.

According to a media release, the mining doyen paid no more than $3 per share.

It appears Rinehart likes Liontown's flagship Kathleen Valley Lithium Project but is not overly impressed with current operations.

In a statement, Hancock Prospecting said:

Whilst Hancock continues to see Liontown's Kathleen Valley project as a significant lithium asset, Liontown's update to the ASX earlier today reinforces Hancock's previous observations that the project faces significant execution, operational ramp-up and market risks.

Should you buy Liontown shares?

Goldman Sachs thinks Liontown shares are fully valued at today's price level.

My colleague James revealed today the broker has reiterated its neutral rating on the ASX lithium share.

The broker said:

We see LTR trading at a premium to our NAV at 2.1x (peer average ~1.1x) or at a LT spodumene price of ~US$1,650/t (peer average ~US$1,100/t), likely in part on M&A activity, while also having a high lithium price valuation sensitivity.

What to watch in October

Keep an eye on Rinehart's holdings, as further buying of Liontown shares may indicate her intention to counter Albemarle's offer or at least snare a seat on the board.

It appears Albemarle is likely to conclude its due diligence process in mid to late October, so we may get some more news then.