The Whitehaven Coal Ltd (ASX: WHC) share price is charging higher on Thursday.

Shares in the S&P/ASX 200 Index (ASX: XJO) coal stock closed yesterday trading for $6.93. At the time of writing, shares are swapping hands for $7.29, up 5.19%.

For some context, the ASX 200 is up 0.24% at this same time.

So, why is the Whitehaven share price having such a cracker day?

What's driving interest in the ASX 200 coal share?

There's no fresh price-sensitive news out from the ASX 200 coal miner today.

But energy prices are broadly trending higher, with crude oil now trading at one-year highs.

Coal remains far below its own one-year highs. But the Whitehaven share price has been getting some tailwinds as coal prices have rebounded from their June lows and are now right around three-month highs.

That combination is seeing outperformance from most ASX 200 energy shares today, as witnessed by the 2.3% gains posted by the S&P/ASX 200 Energy Index (ASX: XEJ).

Investors may also be mulling over the potential benefits and risks ahead for the Whitehaven share price following reports yesterday (courtesy of The Australian) that the miner has offered US$3.5 billion for BHP Group Ltd's (ASX: BHP) Daunia and Blackwater metallurgical (or coking) coal mines, both located in Queensland.

Last week, the ASX 200 miner confirmed it was participating in the sale process of the two BHP coal assets, initiated by the BHP Mitsubishi Alliance.

Management noted that in the company's FY 2023 results, it had reported the temporary suspension of Whitehaven's share buy-back program as the company considers the "application of its capital allocation framework in light of growth opportunities".

Those growth opportunities were confirmed to include BHP's Daunia and Blackwater mines.

At US$3.5 billion, Whitehaven may be paying a modest premium for the two coal assets.

UBS analysis values the Blackwater asset, which has a 50-year mine life, at US$2.5 billion. UBS has an estimated valuation for Daunia, which has a 17-year mine life, of US$800 million.

As at 30 June, Whitehaven held $2.65 billion of net cash on its balance sheet.

Whitehaven share price snapshot

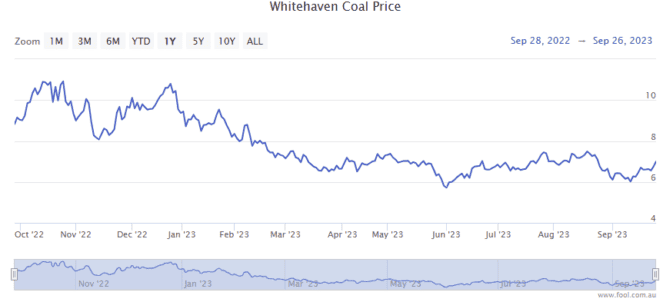

With a strong few weeks behind it, the Whitehaven share price is now up 18.5% since 11 September.

Shares in the ASX 200 coal miner are down 17% over the past 12 months.