The Washington H. Soul Pattinson and Co. Ltd (ASX: SOL) share price is falling as investors make sense of its FY23 full-year results to the public this morning.

Shares in the investment house are down 5.15% to $32.24 in morning trade. For context, the S&P/ASX All Ordinaries (ASX: XAO) is 0.05% higher amid a strong showing from energy shares.

Let's take a look at what the 120-year-old company managed to muster up.

Soul Pattinson share price sinks on strong cash flows

- Group statutory profit of $690.7 million, flipping from a $12.9 million loss

- Group regular profit down 9% to $759.3 million

- Pre-tax net asset value up 8.8% to $10.8 billion

- Net cash flow from investments up 22% to $424.3 million

- Total ordinary dividends up 20.8% to 87 cents per share

The dramatic change in statutory profits can be attributed to a significant non-cash charge in the prior financial year. After acquiring Milton, a fellow formerly ASX-listed investment company, Soul Patts marked down a large one-off impairment charge.

What else happened in FY23?

Soul Pattinson delivered on yet another year of outperformance compared to its benchmark, the All Ords index. For the 12 months ended 31 July 2023, the investment company achieved a 12.3% return on its portfolio when dividends are included, beating the index by 1.2%.

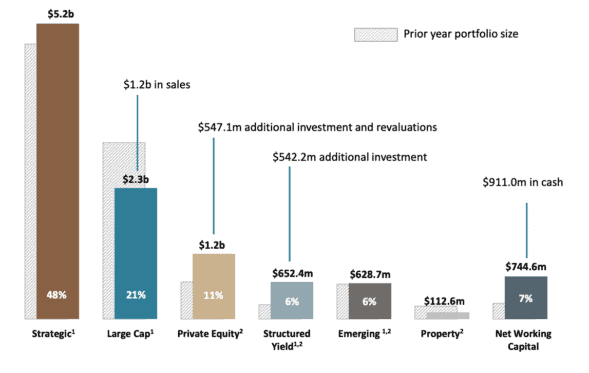

According to the release, FY23 was a period of significant transaction activity and rebalancing. A total value of $3.1 billion was transacted, including the sale of $1.4 billion in equities, as Soul Patts shifted to a heavier positioning in private markets.

Moreover, Soul Pattinson made seven acquisitions in FY23 to deepen its presence in the private investment market. After tipping in $547.1 million of capital, the company's private equity portfolio is now valued at $1.2 billion.

Additionally, the investment team moved some of its capital into the private credit market in FY23 as part of its structured yield portfolio, as shown above. It was stated the shift was made as "higher yielding instruments continue to offer attractive returns in a higher inflationary environment".

The company finished FY23 with $911 million in cash, increasing 87.3% from the prior year. This war chest is currently accruing an average yield of 5.0% per annum.

What did Soul Pattinson's management say?

Addressing the sizeable moves made across the company's investments, Soul Pattinson CEO Todd Barlow said:

It was a highly active year with close to $1 billion allocated to Private Equity and Structured Yield Portfolio investments, which are uncorrelated with equity markets, and deliberate concentration of our Large Caps Portfolio around high conviction positions.

In a higher rate, inflationary environment we are holding significantly more cash, but can be nimble when opportunities arise.

Providing a peek into how FY24 has started, Barlow stated:

Pleasingly, we have started the new financial year in a strong position with the Net Asset Value of the total portfolio outperforming the All Ordinaries Accumulation Index by of 3.9% in the month of August.

Soul Pattinson share price snapshot

The past year has seen the Soul Pattinson share price perform exceptionally, rising 26.5% compared to the benchmark's 8.4%. Based on today's statutory earnings, the investment house now trades on a price-to-earnings (P/E) ratio of approximately 18 times.