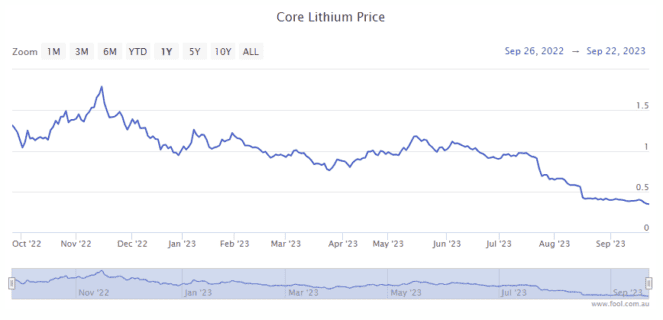

The Core Lithium Ltd (ASX: CXO) share price has slid into new 52-week lows during the past week.

As my colleague Bernd Struben covered on Wednesday last week, shares in the lithium project developer sank to 37 cents apiece at the time — a two-year low. Since then, Core Lithium shares have limped lower again, sitting at 34 cents before Tuesday's market open.

Core Lithium is not alone in its underwhelming performance in 2023. Other pre-production lithium miners, such as Sayona Mining Ltd (ASX: SYA) and Lake Resources Ltd (ASX: LKE), have felt the vice-like pressure of a declining lithium price.

The company also recently completed a capital raise, applying pressure to the Core Lithium share price through further dilution.

Who nabbed some Core Lithium shares?

On 16 August, Core Lithium revealed it was undertaking a capital raise to raise $120 million. The majority of the funding exercise was directed to an institutional placement for $100 million, while the remaining $20 million would be sourced via a share purchase plan (SPP).

Four days ago, the company disclosed the proceeds from its SPP to existing shareholders. Orders fell short of the targeted $20 million, raising only $11.4 million at 40 cents per share.

The proceeds are intended to allow Core Lithium to "deliver on its near-term growth projects during Finniss ramp-up whilst preserving balance sheet flexibility". Prior to the capital raising, the lithium developer held $152.7 million in cash and no debt at the end of June 2023.

All four board members participated in the share purchase plan, as summarised in the table below.

| Board member | Shares acquired | Core Lithium ownership |

| Gregory English | 75,000 | 0.45% |

| Andrea Hall | 75,000 | 0.004% |

| Heath Hellewell | 75,000 | 0.24% |

| Malcolm McComas | 75,000 | 0.17% |

It should be noted that 75,000 shares were the maximum allowable — equating to $30,000 of Core Lithium shares.

After successfully completing the $100 million placement, Core Lithium CEO Gareth Manderson said:

We are pleased with the support demonstrated by new and existing institutional investors in the placement, and we thank our long-term shareholders for their continued support. Importantly, the proceeds provide us with the opportunity to continue progressing our strategic priorities, including optimising recoveries and delivering on our growth objectives […]

The extent of dilution to the Core Lithium share price in 2023 can be determined based on the number of outstanding shares.

At the end of 2022, around 1.842 billion Core Lithium shares were outstanding. After issuing new shares, the company has approximately 2.12 billion tradeable shares. This indicates a 15% dilutive effect from the latest capital raise.