Regular readers would know by now it is unwise to buy ASX shares solely based on a high dividend yield.

That's because it could end up a stinker of an investment if it loses value and ends up eating away all the returns gained from the distribution.

So when an expert picks out specific high-yield dividend stocks as buys, you need to pay attention.

You don't want to miss a unicorn.

Here are two such selections revealed this week:

'A buying opportunity in a high quality business seeking growth'

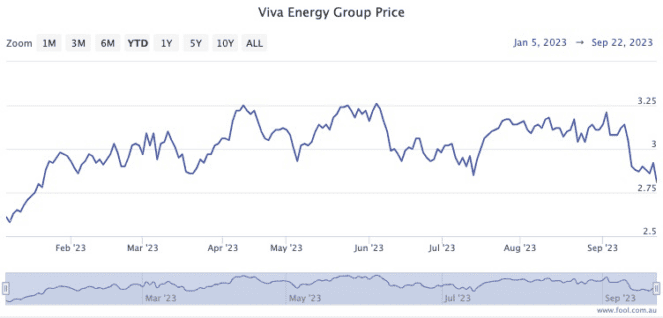

Viva Energy Group Ltd (ASX: VEA) shares have sunk more than 6% since 11 September.

Seneca Financial Solutions investment advisor Arthur Garipoli believes this sell-off is the result of upheaval on the shareholder register, rather than anything sinister in the business.

"The share price of this petroleum distributor and operator of Coles Express has been weaker recently amid a major shareholder Vitol Investment Partnership selling a 16% stake."

But Garipoli told The Bull that the panic is overdone.

"Vitol Investment Partnership remains the biggest shareholder in Viva Energy and has indicated it doesn't intend to sell any further stake in VEA in the short to medium term."

The marvellous thing about the share price drop is that the dividend yield has now expanded to an amazing 9.09%.

And, of course, a tempting entry point.

"The share price fall provides long term investors with a buying opportunity in a high quality business seeking growth."

Five out of 11 analysts currently rate Viva Energy shares as a buy, according to CMC Markets.

'A strong future pipeline of work'

Meanwhile, Argonaut associate dealer Harrison Massey is bullish on GR Engineering Services Ltd (ASX: GNG).

That one has also dipped in recent times, to the tune of 7.63% since the start of September.

Massey cited a pleasing annual report as a reason why he'd back it in the long run.

"GR Engineering generated revenue of $551.4 million, EBITDA of $44.4 million and an EBITDA margin of 8.1% in fiscal year 2023, which beat analyst forecasts."

The fact is the engineering services provider has a bright outlook.

"The company has a strong future pipeline of work, and the current order book includes BHP Group Ltd (ASX: BHP)'s $312 million West Musgrave mine project."

Similar to Viva, the GR Engineering dividend yield is mouth-watering, currently standing at 8.72%.

"The company has a history of distributing attractive dividends to shareholders and paid out 19 cents in fiscal year 2023."

The small-cap stock is sparsely covered, but at least Euroz Securities agrees with Massey, with a strong buy rating.