The Australian share market is clawing its way higher on Wednesday, fortified by some pleasing financial reports today. Yet, one ASX 200 stock stands out from the crowd after sharing its FY23 full-year results with the market this morning.

Impressing onlookers, the IDP Education Ltd (ASX: IEL) share price is up 10.33% to $25.70 in early afternoon trading. For context, the broader S&P/ASX 200 Index (ASX: XJO) is 0.71% better off than where it finished yesterday.

Let's see what all the fuss is about.

What is sending this ASX 200 stock flying today?

The past year has been an unrewarding time for the IDP Education share price. Before today, shares in the language testing service provider had fallen 12% over a year. However, a record result for the 12 months ending 30 June 2023 has reinvigorated the company's shares.

Here's a quick summary of the noteworthy figures for FY23:

- Revenue up 24% to a record $982 million

- Student placement volumes up 53% to a record 84,600

- IELTS test volume up 1% to 1,932,500

- Adjusted net profit after tax (NPAT) up 45% to $154.2 million

- Final dividend of 20 cents per share, increasing 48% from the prior final dividend

The company grew its most significant revenue segment (English Language Testing) by 7% to $545.5 million in FY23 despite flat test volumes. This was achieved by rolling out price increases across its network during the financial year.

Meanwhile, the 'student placement' segment performed strongly, dialling revenue up by 63% to $351.2 million. Australia delivered the highest growth rate in this category, increasing by 86%.

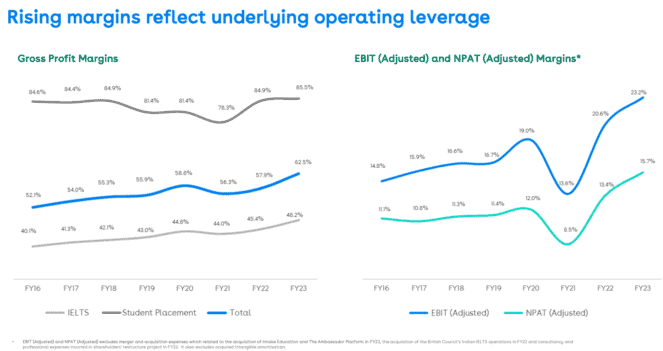

While total revenue grew by 24%, management kept the lid on direct costs, rising a lesser 10% in FY23. As a result, gross and net profits outpaced revenue growth, growing 34% and 45%, respectively. This was highlighted as "demonstrating strong operating leverage in the business model", as shown above.

Shorters left to lick their wounds

The considerable move to the upside in this ASX 200 stock will have short sellers hurting today. Per our recent 10 most shorted ASX shares, IDP Education shares were heavily shorted heading into this result, amassing a 9.4% short interest.

It appears traders expected the company to disappoint following a change in Canadian language testing in May this year. A decision made by Immigration, Refugees and Citizenship Canada (IRCC) meant IDP Education would no longer hold a monopoly on English tests for new Canadian entrants.

According to IDP's FY23 report, Canada remains its third-largest destination market. Additionally, student placement revenue across Canada increased 44% year on year.

Even with today's increase, this ASX 200 stock remains down 2.7% over the last 12 months.