Who can turn their nose up at a bargain? It's almost innate to want to buy ASX shares when they are cheap, as is the desire to get a better deal on everyday purchases.

Unfortunately, all too often, this leads to investors scooping up companies that are trading on low price-to-earnings (P/E) ratios, convinced they're making a great investment. What can ensue in the following years is a company that sheds its sheepish clothing to reveal a wealth-eating wolf.

The humble P/E ratio can be a handy tool on the investing toolbelt, but it shouldn't be the only one.

Cheap doesn't always mean value

Legendary stockpicker Warren Buffett has said before, "Price is what you pay, value is what you get." In all its simplicity, it can be easy to misunderstand what is really being conveyed in this statement.

The point is the price is secondary. It's impossible to know whether you're getting a good deal until knowing what it is you are getting for the price. Only then can an informed decision be made on whether an investment might present good value for money.

What makes it even trickier is that future value can be different to historical value.

For example, imagine you're looking for a set of sheets. A set of Egyptian cotton sheets have been selling for $150 for the past year. Suddenly, the store calls you up, "Hey, we're taking orders for next year… $75 and they're yours. The only catch is there's a good chance they end up being polyester."

You think to yourself… I can go buy standard polyester sheets for $20. Why would I pay $75? If they turn out to be polyester, that's not really good value for my money.

Essentially, a lot of 'cheap' ASX shares can turn out to be $75 polyester sheets.

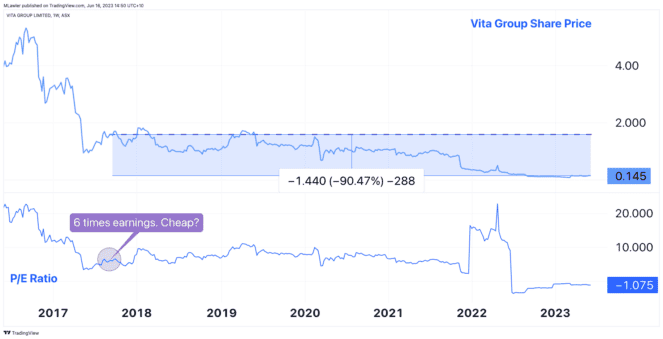

My favourite personal example of this is Vita Group Limited (ASX: VTG). Early into my investing journey, I came across this company that looked dependable — leasing out stores to Telstra Group Ltd (ASX: TLS) — safe as houses, I thought.

At the time, Vita Group was trading on a trailing P/E of around 6 times earnings. I was sold. How could an ASX share be so cheap?

Well, it turns out Vita wasn't so dependable. After Telstra bought back its stores, Vita wasn't left with much of a business.

Despite never trading for more than 11 times earnings between 2018 and 2020, the company's shares gradually became worth less and less.

From 'cheap' at $1.50, to not wanting to touch it at 15 cents.

Which ASX shares are suspiciously cheap?

Flicking through a list of Aussie companies currently available for earnings multiples under 10, there are five that raise some concerns.

- Seven West Media Ltd (ASX: SWM) — 3.1 times earnings

- Rural Funds Group (ASX: RFF) — 2.9 times earnings

- Elders Ltd (ASX: ELD) — 7.8 times earnings

- Magellan Financial Group Ltd (ASX: MFG) — 7.2 times earnings

- Autosports Group Ltd (ASX: ASG) — 6.2 times earnings

Firstly, in my opinion, Seven West faces challenges with declining revenue from traditional media and increasing competition from Netflix Inc (NASDAQ: NFLX) and Walt Disney Co (NYSE: DIS) with the introduction of ad-supported tiers.

Furthermore, Rural Funds and Autosports could see their earnings reduce in coming years as profits normalise. Autosports has enjoyed above-average margins amid car supply shortages. Whereas Rural Funds has booked large profits from one-off gains in the past year.

Lastly, both Elders and Magellan are facing their own set of challenges. The Aussie agribusiness could see greater deterioration in business conditions if a drought grips the country. Meanwhile, Magellan is still trying to stem the outflows from its managed funds.

All of this is to say, it's worth taking a deeper look into a company before labelling it as a cheap ASX share. The abovementioned businesses might still represent value, but if they do, it won't be evident from the P/E ratio alone.