For beginner ASX dividend investors, it can be very tempting to seek out shares that offer the highest dividend yields. If a company has a dividend yield of 7, 8, or even 9%, and it comes with full franking credits, this certainly is enough to make one think of the possibilities.

But often, ASX shares sporting dividend yields this high turn out to be traps. See, a company is under no obligation to fund a dividend at any time. Many shares, especially those in cyclical industries, will vary their payouts over time. Some companies that are under duress will cut or even eliminate their dividends altogether.

A dividend yield generally reflects what a company has paid out in the past, not what it will pay in the future. Some novice investors will see a high trailing yield figure and assume the good times will keep rolling. But the market generally knows better and, as such, tends to price dividend shares accordingly.

Remember, a dividend yield figure is just as dependent on a company's actual share price as the dividends per share the company pays. So if the markets sell down a stock, its trailing dividend yield will rise. This doesn't necessarily make the stock worth buying.

So, if you see a dividend share with a yield above 7%, ask yourself why some investors are staying away.

What is an ASX dividend share trap?

A good example is the dividends of Magellan Financial Group Ltd (ASX: MFG). Last year, Magellan forked out an interim dividend of $1.10 per share, fully franked. Together with the final dividend of 69 cents per share investors received in September, that would have given Magellan shares a trailing yield of 22.55%.

That was until February, when Magellan shares traded ex-dividend for 2023's interim payment. Instead of $1.10 per share, investors received just 46.91 cents per share. So now, the company's trialling yield is at a far lower 14.58%. So anyone who bought Magellan shares in January expecting a 22% yield would feel a bit silly right now.

And the fact that Magellan's dividend yield is still extremely high suggests investors are expecting more cuts of this magnitude going forward. Otherwise, its share price would be driven higher as investors flood in to secure that 14.58% yield.

That's why it is often the case that a low dividend yield is a far more beautiful thing than a high dividend yield.

But don't take it from me. Take it from an expert: The Motley Fool's own Lead Advisor and Equity Analyst Ed Vesely. Here are some of Ed's thoughts on the beauty of a low dividend yield:

Such low valuations that come with those high yields imply a level of risk or danger that I just would not want to take on…

Instead, we look to those companies that pay much lower yields.

Not too low, mind you. But at a level where we think the income on offer compensates investors for the risk for buying those shares in those businesses. When we get the balance right, we can enjoy both a reasonable level of income, and a dividend that grows over time, in line with its economic performance.

When is a low dividend a better dividend?

Let's now find a beautiful yet seemingly low dividend yield to illustrate. Right now, the Washington H. Soul Pattinson and Co Ltd (ASX: SOL) dividend yield is sitting at a seemingly unimpressive 2.44%, albeit fully franked.

Now that might not attract too many novice investors. After all, you can get a term deposit these days offering around double that yield.

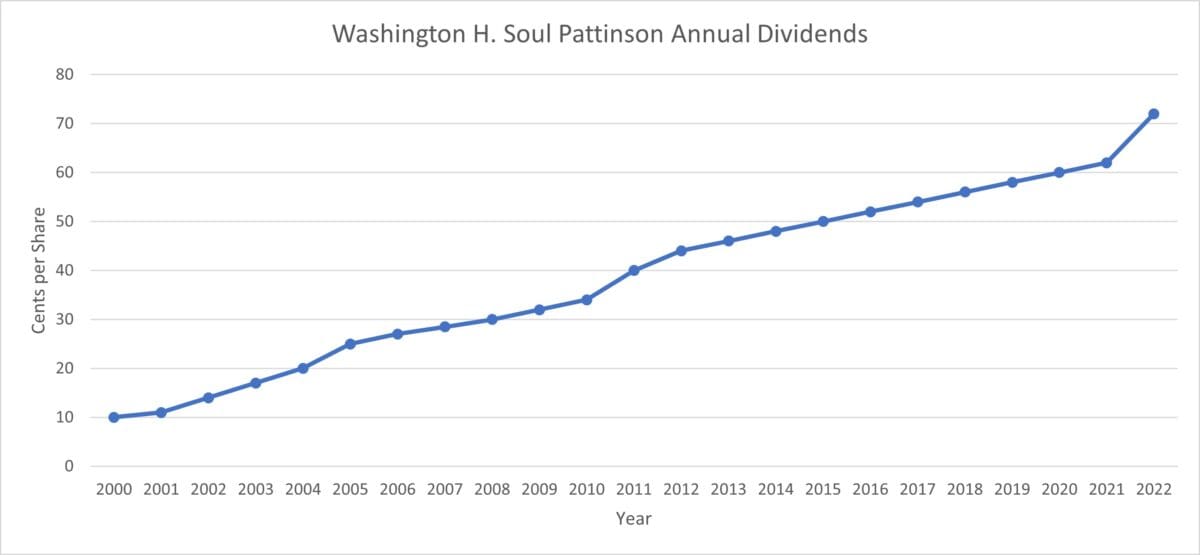

But consider this: Soul Patts has given its investors an annual dividend raise every single year since 2000. This is what that looks like on paper:

As we looked into last month, an investor who bought into Soul Patts shares at the start of the year 2000 would actually be getting an approximate 22.3% yield on their cash today. In the flesh. Is there anything more beautiful in the investing world than that?

So a high dividend can be a mirage – it looks captivating from far away but evaporates when you get your cash close to it. It's far better to look for companies that are slowly but steadily raising their dividend over time. A low yield turning into a high yield the longer you wait is the true beauty of dividend investing.