Well, it has finally happened, and a lot sooner than what many investors expected. The giant American semiconductor stock NVIDIA Corporation (NASDAQ: NVDA) has become a member of the ultra-exclusive trillion-dollar club.

Yes, overnight, NVIDIA's market capitalisation went over US$1 trillion for the first time ever. It was a brief affair, with NVIDIA hitting a high of US$419.38 a share (a new all-time high share price too), toward the front end of last night's US trading session. The company ended up finishing at US$401.11 a share, which puts its market cap at US$992 billion.

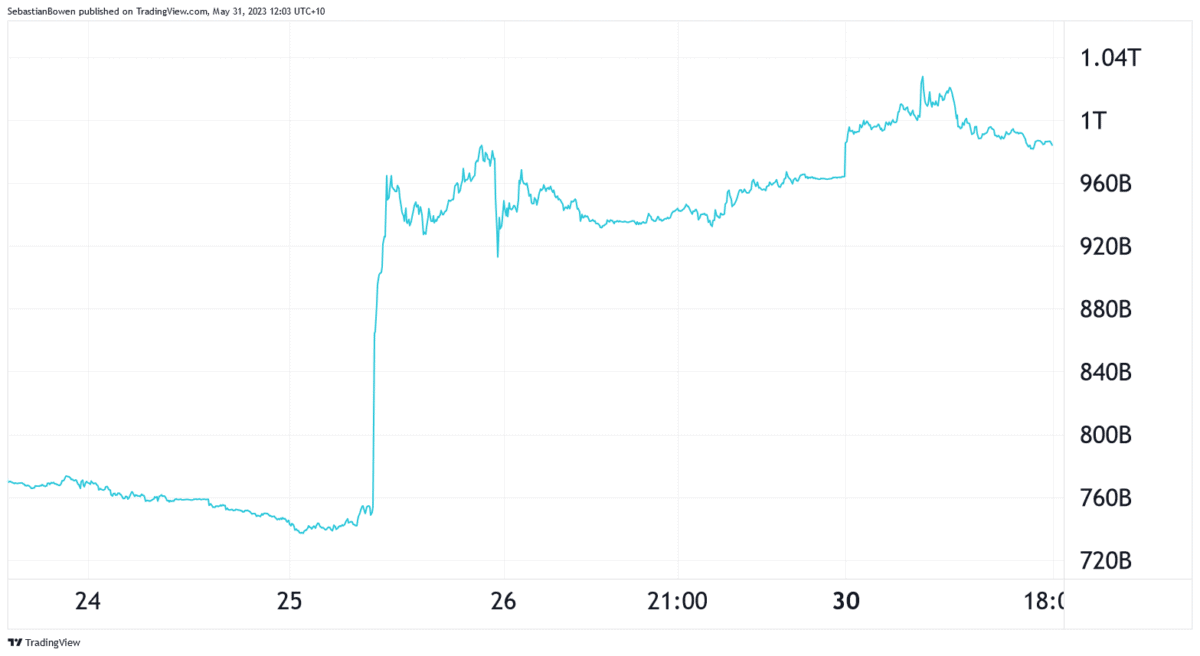

But hey, in the words of Akon and Lonely Island, 'still counts'. NVIDIA is now a member of the US$1 trillion club. You can see how this journey unfolded below:

NVIDIA is only one of a handful of global companies that have ever commanded a market cap above US$1 trillion. The current members of this exclusive clique include fellow tech giants Apple Inc (NASDAQ: AAPL), Microsoft Corporation (NASDAQ: MSFT), Amazon.com Inc (NASDAQ: AMZN), Alphabet Inc (NASDAQ: GOOG)(NASDAQ: GOOGL) and Middle Eastern oil giant Saudi Aramco.

The first US$1 trillion semiconductor stock

US electric vehicle and battery manufacturer Tesla Inc (NASDAQ: TSLA) was also once a member of the club, before falling out of it last year.

In fact, Apple, Microsoft, Amazon and Saudi Aramco have all been members of the even more exclusive US$2 trillion club before, with Apple and Microsoft alone maintaining membership at present.

So as you can see in the above image, NVIDIA's share price (and market cap) started to take off last week. The catalyst was the quarterly earnings report that NVIDIA posted. The company revealed a 26% surge in net income to US$2.04 billion from revenue of US$7.19 billion.

But investors seemed most excited about NVIDIA's revenue projections. The company estimates that it will be able to bring in a whopping US$11 billion in revenue over the upcoming second quarter, which would be a truly massive rise over the US$7.19 billion just reported.

Where to next for NVIDIA stock?

But many investors might be asking 'where to from here' for NVIDIA stock. After all, it is certainly uncommon to see a company of NVIDIA's size rise by more than 30% in just one week, and by 115% over a 12-month period.

Well, at their new levels, NDIVIA stock doesn't exactly look cheap. The company currently boasts a price-to-earnings (P/E) ratio of just over 208. In comparison, Apple and Microsoft's P/E ratios are currently sitting at 30.12 and 35.9. That means that investors are being asked to pay US$208 for every US$1 of earnings from NVIDIA, but just US$30.12 for every US$1 that Apple brings in.

However, NVIDIA's P/E ratio is clearly based off its startling growth projections. If the company can keep growing at anything close to what it is estimating for its next quarter over the next few years, that P/E ratio can arguably justify such a valuation. That's certainly the view of a number of analysts that we discussed last week.

As we covered at the time, Rosenblatt analyst Hans Mosesmann put a share price target of US$600 for NVIDIA, which would mean the company gains another 30% or so from its current share price. So NVIDIA's future will probably hinge on whether its next quarterly numbers come in where the company has estimated, and what kind of growth rate it projects from there. Let's see what happens.