Over the past year, the S&P/ASX 200 Index (ASX: XJO) has produced a net total return of 4.4%. Not a terrible outcome without any further context. However, for a lot less risk, one can now generate the same return on cash at the bank.

The question then becomes, is a broad market index the place to be moving forward? Some investors think possibly not — despite paying a lower-than-normal multiple on market earnings — due to the risk of earnings declining from their historically high levels.

Instead, contrarian fund manager Allan Gray Australia is eyeing value in the unloved pockets of the share market.

A shot at asking for more

There are no free handouts in the investing arena. In most cases, there is a rather justifiable reason for shareholders to part ways with a stock. Contrarian investors go hunting in these waters, searching for companies that may be temporarily distressed, but not structurally broken.

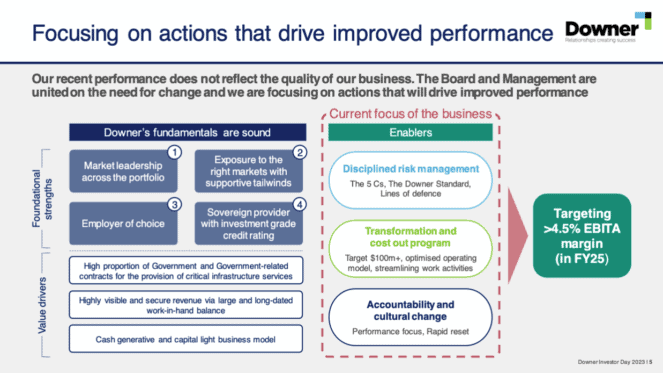

Speaking at the Allan Gray Investment Forum in Brisbane last week, chief investment officer Simon Mawhinney revealed Downer EDI Ltd (ASX: DOW) as one such business his team has identified.

The ASX 200 company provides an array of important services across Australia and New Zealand, categorised into three segments: transport, utilities, and facilities.

Despite the critical nature of Downer's services and the company's market leadership, it has long accepted egregiously low margins. It is this issue that Mawhinney and the team are optimistic Downer can change.

In February, Downer's management revealed ambitions of delivering EBITA margins of more than 4.5% in FY25, as shown above. For context, the figure came in at 2.5% in the latest half-year results.

If the company can deliver on this target, the valuation begins to look 'cheap', as Mawhinney highlighted. The ASX 200 share would trade at around eight times EBITA based on its current enterprise value of around $4 billion — far cheaper than the 17 or 18 times market average.

Meanwhile, the downside risk is Downer maintains current unsatisfactory margins and continues to trade in line with the broader market. Hence, the fund manager is of the mind this business represents an opportunity with an asymmetric skew to the upside.

Are better returns ahead for this ASX 200 share?

Testing the faith of its shareholders, Lendlease Group (ASX: LLC) shares have sunk 25.6% in the last 12 months.

The company's margins have been under pressure since the onset of the pandemic, dispersing any inkling of optimism among many. Though, the Allan Gray team is looking beyond the near term to hold a contrarian view on this real estate heavyweight.

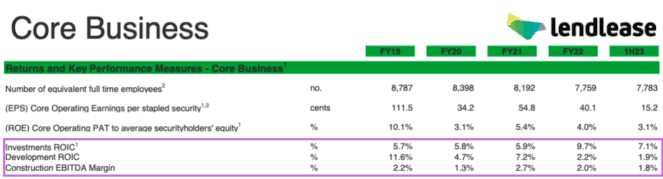

Now holding a 3% weighting in the Allan Gray Australia Equity Fund, the team sees value in Lendlease if it can make progress on its own targets across its construction, development, and investment segments.

In his presentation, Mawhinney called out Lendlease's ambitions of improving its return on invested capital (ROIC) — 10% to 13% for developments and 6% to 9% for investments. Likewise, the company is targeting a 2% to 3% EBITDA margin for construction. This would all equate to an 8% to 10% margin in aggregate.

For comparison, the company's historical ROIC and EBITDA margin are shown below.

If Lendlease can reach its own targets, the business "would be trading at 8 to 10 times earnings", Mawhinney stated. Elaborating on the Lendlease opportunity, the investor said:

Not bad, if not very, very cheap, if management is correct and they haven't overpromised. The likelihood is that they have overpromised and it's not as cheap as that, but there's a very large margin of safety implicit in Lendlease's price today.

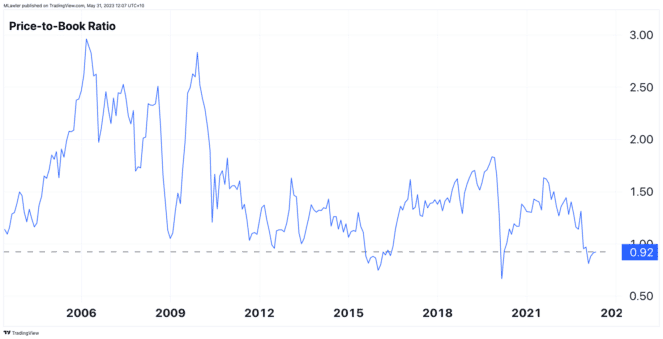

That margin of safety Mawhinney mentions is likely pertaining to the current price-to-book (P/B) ratio of this ASX 200 share.

Investors can grab Lendlease shares for less than their book value at the moment. That's an event that has occurred only a few times since 2003, as pictured above.