The Woolworths Group Ltd (ASX: WOW) share price has had a very pleasing year so far in 2023. Since January, Woolworths shares have risen from just over $33 to the $38.04 that we see today. That's a gain worth a healthy 15%, which far outstrips the S&P/ASX 200 Index (ASX: XJO)'s gain of 2.9% over the same period.

However, I have a confession. I have a major problem with the Woolworths share price right now.

Don't get me wrong, I think Woolworths is one of the best companies in Australia. It is completely dominant in its grocery and supermarket sector, thanks to a strong brand and high consumer loyalty. It is a tightly run company that is comfortably profitable. It is also an inherently defensive business thanks to its consumer staples nature.

But I don't think Woolworths is a good investment today. The problem I have with the Woolworths share price comes down to valuation.

Right now, the Woolworths share price has a price-to-earnings (P/E) ratio of 27.86.

That means investors are being asked to pay $27.86 for every $1 of earnings that Woolworths generates.

The Woolworths share price is just too expensive

That, in my view, is expensive. To illustrate, right now, Woolies' arch-rival Coles Group Ltd (ASX: COL) has a P/E ratio of 21.74.

Commonwealth Bank of Australia (ASX: CBA) is the most expensive ASX 200 bank share, but even it currently has a P/E ratio of 17.3.

In fact, Woolworths shares have pretty much the same price-to-earnings ratio as Google-owner Alphabet Inc (NASDAQ: GOOG)(NASDAQ: GOOGL) right now. Even Apple Inc (NASDAQ: AAPL) is only a little higher at 29.4.

When I think of companies like Apple or Alphabet, I can see a clear path for these shares to grow meaningfully over the next decade, given their global dominance.

But is Woolworths really on that kind of scale? It's arguable that Woolworths is at complete market saturation here in Australia. Sure, it might eke out some growth over the next few years thanks to cost savings, productivity increases and population growth.

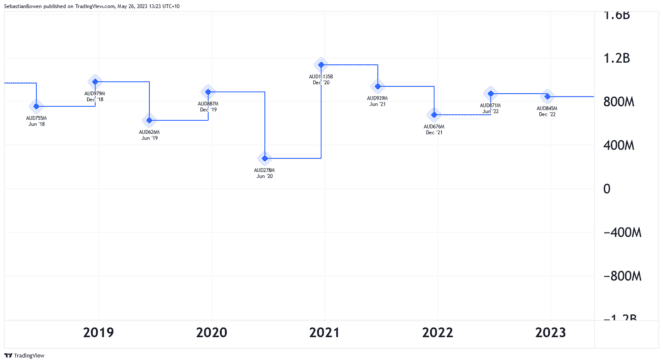

But just take a look at the company's net income over the past five years:

Doesn't look like breakneck growth to me. And certainly not enough to justify a P/E ratio in the high 20s, in my view.

Don't get me wrong, Woolworths is a quality business that spins off billions in profits every year. But I believe that the markets are pricing Woolworth far too high today to make it a good investment going forward.

If the company was trading at a valuation more similar to that of Coels, even at a slight premium, it would be far more compelling. But as it stands today, I don't see anything I like in Woolworths' P/E ratio of 27.86 or its dividend yield of 2.6%.