Many ASX dividend shares can pay investors a solid dividend yield. Indeed, there are some names that have an impressive payout growth streak going on.

Of course, nothing is guaranteed with dividend payments — they aren't like term deposits. But if a business can grow its dividend per share year after year then it can be very rewarding, and a fine protection against inflation.

We can't know for sure which businesses are going to increase their payouts, but their past records can indicate how committed a company is to increasing shareholder returns over time. Below, I'm going to talk about two of the companies with the longest dividend growth streaks.

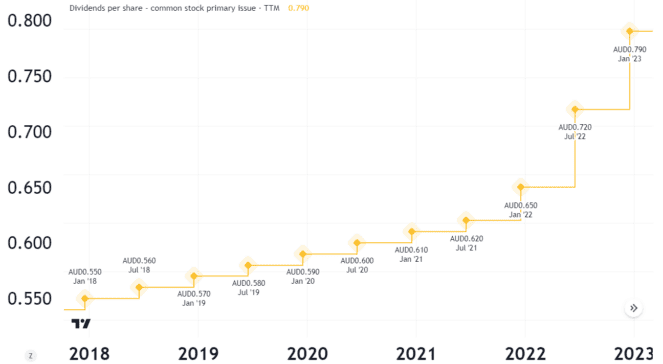

Washington H. Soul Pattinson and Co. Ltd (ASX: SOL)

I'd describe Soul Pattinson as the ASX dividend share with the strongest dividend record. It has grown its dividend every year since 2000. The business has also paid some sort of dividend every year since it listed more than 100 years ago.

As we can see on the graph above, the dividend growth rate has picked up in the last couple of results. The recent FY23 half-year result showed a 24.1% increase in the interim dividend.

Soul Pattinson pays its dividend from the cash flow it receives from its investment portfolio of ASX shares, private businesses, and structured debt. Some of its biggest investments include Brickworks Limited (ASX: BKW), TPG Telecom Ltd (ASX: TPG), New Hope Corporation Limited (ASX: NHC), and Macquarie Group Ltd (ASX: MQG).

After paying its dividend, the ASX dividend share can then re-invest in more opportunities.

One of the company's goals is to keep growing the dividend. Another objective is to outperform the market.

Using the company's last two declared dividends (including the special dividend), it has a grossed-up dividend yield of 4%.

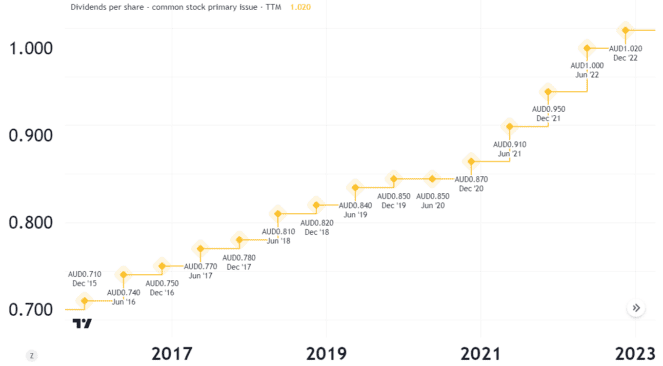

Sonic Healthcare Ltd (ASX: SHL)

Sonic is one of the world's largest pathology businesses with a significant presence in Australia, the US, the UK, and Germany.

People can't decide when to get sick based on economic cycles so ASX healthcare shares can provide shareholders with resilient earnings and dividends. As well, the increasing populations — and their ageing — in those major markets certainly provide a useful tailwind for healthcare earnings.

The ASX dividend share has grown its dividend each year since 2013, so its growth streak has been going on for around a decade now.

The company's non-COVID testing revenue continues to grow, which bodes well for future profit generation and larger dividends. The business has a stated "progressive dividend policy", meaning the board wants to grow the dividend each year, if possible.

The business continues to make bolt-on acquisitions, such as its two recent acquisitions in Germany that, between them, are expected to add €115 million (A$186.6 million) of revenue in FY24.

As well, the company's expansion into artificial intelligence and its partnership with Microba Pty Ltd (ASX: MAP) in microbiome testing could boost Sonic Healthcare over time.

Sonic Healthcare's trailing grossed-up dividend yield is also 4%.