The Whitehaven Coal Ltd (ASX: WHC) share price has crumpled by almost 27% since ticking over into 2023. Unfortunately, the disappointing showing puts the coal producer among some of the worst-performing ASX 200 shares on a year-to-date basis.

Shares in the Australian coal miner are still up 45% from where they were a year ago. However, shareholders have been taking their money and running amid a declining coal price.

Remarkably, the skyrocketing earnings and the falling share price have resulted in a price-to-earnings (P/E) ratio of 1.9 times. For context, the industry average for energy shares hovers around 6.6 times earnings.

So, could it be time to back the dump truck up and shovel this ASX 200 share into the portfolio?

Coal is the maker or the breaker

Mining and selling a commodity is a tough business. When it's good, it's great, and when it rains, it pours — that's the cyclical nature of the industry. This is because the going price of the commodity — which is driven by supply and demand — largely determines the company's profits.

It's a dynamic that has worked in the favour of Whitehaven shareholders over the past year. The energy-dense commodity's price leapt from around US$150 per tonne to US$450 per tonne while costs held steady. As a result, the income margin ballooned from basically nothing to more than 45%.

But now comes the rain…

Coal prices have retreated abruptly this year, dropping back to within the pre-2022 range. Meanwhile, the ASX 200 share revealed increasing costs in its latest half-year results. Those two factors combined likely mean thinner margins are inbound.

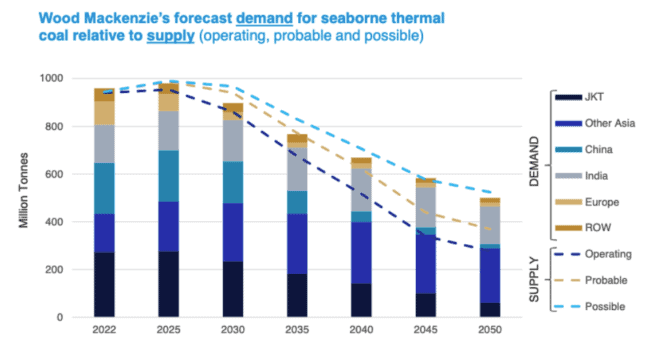

To worsen matters, by the company's own admission, thermal coal demand is expected to fall from 2025 onwards. Though, Whitehaven Coal's management is banking on a shortfall in supply to heave prices higher.

It seems the market is now questioning whether prices will bounce back to drive sustained shareholder returns.

Would I buy this ASX 200 share?

I'm unconvinced that renewable energy will replace fossil fuels in this decade. In 2021, clean energy sources accounted for 32.5% of Australia's total electricity generation, increasing from 27.7% the prior year.

However, at the current rate, we could potentially see 80% of our total electricity demand sourced from renewables in 10 years. I'd expect this will weigh on Whitehaven's sales for thermal coal, but metallurgical coal — used for steelmaking — might be sustained.

The other issue the company could face is rising costs. As of 16 February 2023, Whitehaven is guiding for the cost of coal to be between A$95 per tonne to A$102 per tonne. If coal prices were to continue to fall, margins would obviously come under pressure.

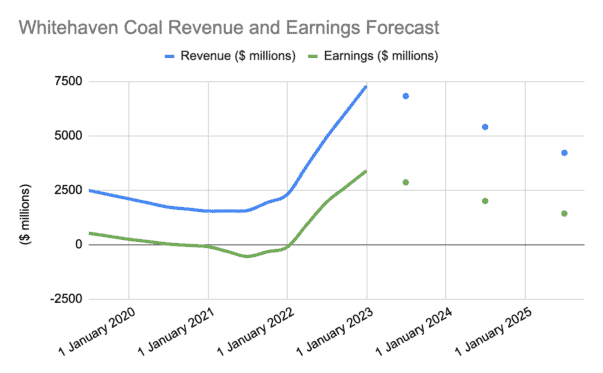

As shown above, analysts' estimates (depicted as dots) suggest earnings declines could be on the horizon. By FY2025, net profits after tax (NPAT) could be $1,429 million, compared to $3,393 million for the 12 months ending 31 December 2022.

For the reasons above, I personally wouldn't be a buyer of this ASX 200 share.