A year of robust earnings across energy and resource companies meant another solid year for ASX dividend shares in 2022.

The supply shortage of many commodities was intensified by Russia's invasion of Ukraine and the ensuing sanctions. In turn, many companies that were able to provide the in-demand commodities were practically minting money.

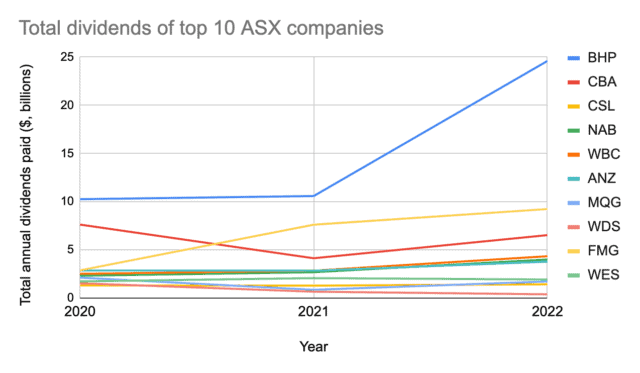

Incredibly profitable years for the likes of BHP Group Ltd (ASX: BHP), Woodside Energy Group Ltd (ASX: WDS), and Whitehaven Coal Ltd (ASX: WHC) supercharged the total dividends paid to shareholders last year.

However, the focus is now squarely on what awaits our dividend streams in 2023.

Growing through economic pain

Flicking through forecasts shared by analysts, opinions are divided on what this year could look like. Although, there appear to be two generally common views on S&P/ASX 200 Index (ASX: XJO) companies for this year:

- Rising costs and falling consumer spending could impact the earnings capacity of some companies

- There will still be pockets of opportunity for sustained or increased dividends

In its November edition of the Global Dividend Index report, Janus Henderson noted its belief that slower economic growth could take a toll on payout growth for some companies.

Furthermore, the asset manager highlighted the rebasing of dividends to a more sustainable payout ratio during COVID-19 as a way for companies to potentially maintain — even grow — dividends through weakening earnings.

Total dividends paid by the 10 largest ASX shares have mostly risen over the past few years, as shown above. Janus Henderson is optimistic based on lowered payout ratios.

However, only three of these ASX 200 companies currently hold a payout ratio of less than 60% — CSL Limited (ASX: CSL), ANZ Group Holdings Ltd (ASX: ANZ), and Macquarie Group Ltd (ASX: MQG).

Which ASX dividend shares could deliver?

The Sydney-based investment management firm, Plato Investment Management, has its eyes on certain areas of the Aussie market this year.

According to Plato's managing director, Don Hamson, the strength in resources and financials could continue in 2023. Hamson provided Woodside, BHP, and Macquarie as three ASX 200 shares with 'strong and sustainable' dividends in a recent note.

Additionally, Hamson said, "I think it goes without saying that favouring companies that pay fully franked dividends, where possible, in 2023 is a no-brainer."

In the same note, the fund manager cautioned against defaulting to cash amid higher interest rates.

At first glance many retirement income investors have heralded this as a win, with term deposits and other so-called safe asset classes expected to generate stronger yields.

But they're overlooking the elephant in the room – inflation.

The Plato team project the ASX 200 to provide investors with a 6% return in 2023 after franking credits.