This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

After Tesla's (NASDAQ: TSLA) recent three-for-one stock split, you might be wondering if now is the ideal time to buy Elon Musk's dynamic electric vehicle (EV) company.

The split has not been beneficial for the stock; its price has declined nearly 10% since it took effect.

But that decline likely has more to do with the larger market selloff since concerns around prolonged inflation continue to punish equities.

Long-term investors understand that declining stock prices create potential buying opportunities. So with the tech-heavy Nasdaq Composite also down more than 10% over the last few weeks, what is the better opportunity right now: Tesla or a Nasdaq index fund?

If you're an investor with a strong stomach for volatility, I believe Tesla offers greater potential due to its many similarities with other once-in-a-generation stocks.

Unmatched efficiency

Many of the greatest companies today have one thing in common: They flip traditional business models on their heads.

Tesla has done this in many ways, but none are more apparent than its manufacturing efficiency. This has largely been accomplished by Musk's first-principles approach to building his cars.

Atomic Habits author James Clear defines first principles thinking as "... the act of boiling a process down to the fundamental parts that you know are true and building up from there."

The average automobile consists of about 30,000 parts. By contrast, the Tesla Model 3 is made up of around 10,000 parts, and the drivetrain has only 17 to 18 individual pieces compared to a standard internal combustion engine, which has around 200 parts.

Tesla has been able to achieve this manufacturing efficiency through its Giga Press, a large-scale die-casting machine. Instead of casting thousands of individual parts and welding or gluing them together, the Giga Press can produce large portions of the car in a single cast.

For example, the entire rear section of the Model Y is cast in a single mold, which would traditionally consist of over 70 individually produced parts. This innovation alone eliminates approximately 300 robots and reduces the body shop's space by 30%.

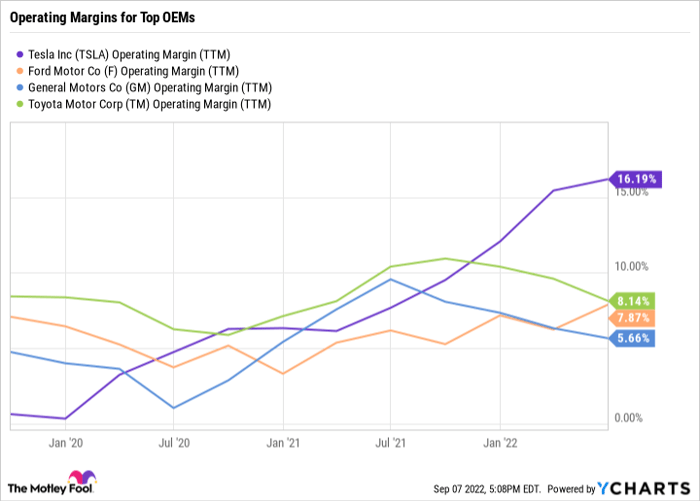

This manufacturing efficiency can be seen in the company's operating margins, which significantly beat the competition.

TSLA operating margin (TTM). Data by YCharts. TTM = trailing 12 months.

Tesla is a data company

The biggest oversight many investors make when analyzing Tesla is thinking of it as simply a car manufacturer. You've likely seen the various articles pointing out that Tesla's market capitalization equates to roughly all of the other major automobile manufacturers combined.

While Tesla's leadership in the EV space certainly contributes to its lofty valuation, I believe the main justification has more to do with its data-centric business model.

Tesla vehicles are essentially computers on wheels, and just like all of the best companies today, the company is leveraging the data captured by its computers to maximize its value proposition.

This is clearly seen in its push toward autonomous driving. While Musk has been infamously overly optimistic about the release of the company's Full Self Drive (FSD) feature, Tesla has been beta-testing it for nearly two years and recently surpassed over 100,000 vehicles on the road actively testing the software.

For reference, Alphabet's (NASDAQ: GOOG)'s Waymo, a major competitor in the autonomous driving space, has an estimated 600 autonomous vehicles being tested on the road today.

FSD is built on a foundation of machine learning, so each mile driven by owners is in theory enhancing its capabilities. Tesla's lead in testing autonomous vehicles is just one example of how it's using its proprietary data as an advantage over its competitors.

Other examples of the company's use of data capture can be seen in its metric-based insurance product as well as its over-the-air software updates.

While the valuation is lofty, the profits are flowing

Tesla's valuation is without a doubt the biggest concern for buying the stock. With a price-to-earnings (P/E) ratio of over 100, there's not much of a claim that the stock is cheap.

But while that valuation is high, consider how drastically the P/E has been reduced over the last few years:

TSLA PE ratio. Data by YCharts.

This is in part due to the pullback in the overall market, but it's also a result of Tesla's dramatically increasing profitability.

| Tesla's Consolidated Net Income (Loss) | |||||

|---|---|---|---|---|---|

| 2017 | 2018 | 2019 | 2020 | 2021 | YTD |

| ($2.2 billion) | ($1.1 billion) | ($775 million) | $862 million | $5.6 billion | $5.4 billion |

Data source: Tesla. Table by author.

Tesla isn't a value play, but a bet on optionality. Even at today's lofty prices, I believe there is tremendous upside if the company delivers on its wide array of disruptive products (autonomous driving, robo-taxis, robotics, solar energy, and more).

Very few of the highest-valued companies today ever traded at traditionally cheap valuations. There is certainly risk baked into this investment, but the range of potential outcomes for Tesla is astronomical, and it reminds me a lot of another high-flying technology company that was critiqued for years as being massively overvalued.

It's Amazon, whose founder, like Elon Musk, also sends rockets into space.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.