This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

On July 21, Amazon (NASDAQ: AMZN) announced that it would buy One Medical in a deal valued at $3.9 billion. Its purchase of a tech-powered healthcare company is a step in a direction that many investors have been calling for Amazon to take.

Healthcare services promise to be more profitable than Amazon's e-commerce segment, which has been weighing on the company's profit margins. In contrast, its web services segment has carried the load. Let's look at how this move combines with a few more recent changes to tell a story of an Amazon that's emphasizing profitability.

Investing in a tech-infused healthcare services business

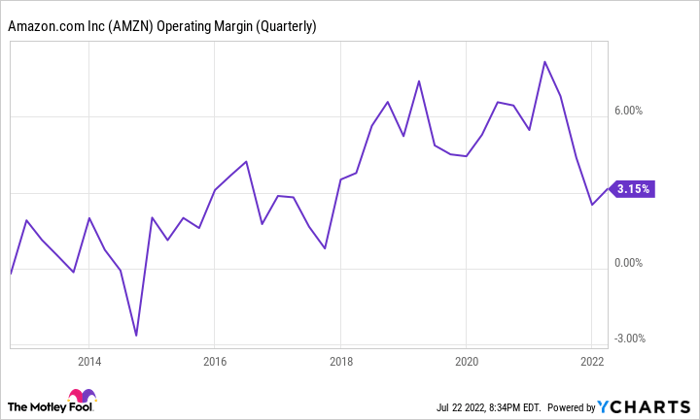

E-commerce sales have always been a thin-margin business for Amazon. That could explain why its operating profit margin has stayed below 10% for the past 10 years. To make matters worse, it's becoming even more expensive to sustain that segment. As inflation has taken hold, Amazon's labor, fuel, and fulfillment input costs have increased substantially in the last year.

AMZN Operating Margin (Quarterly) data by YCharts.

In its most recent quarter, which ended on March 31, Amazon's shipping costs increased by 14% while its number of units shipped remained unchanged. In other words, shipping each item costs Amazon roughly 14% more. Given the relatively negative outlook for e-commerce sales, investors can be pleased with Amazon's latest decision to purchase the healthcare services company.

According to Neil Lindsay, senior vice president of Amazon Health Services, in a press release:

We think health care is high on the list of experiences that need reinvention. Booking an appointment, waiting weeks or even months to be seen, taking time off work, driving to a clinic, finding a parking spot, waiting in the waiting room then the exam room for what is too often a rushed few minutes with a doctor, then making another trip to a pharmacy -- we see lots of opportunity to both improve the quality of the experience and give people back valuable time in their days.

Moreover, service businesses tend to be higher-margin and less capital-intensive. Costs also tend to be variable rather than fixed, protecting any decreases in revenue. That could be more of what investors like to see from Amazon as its fulfillment centers require large capital investments up front and are expensive to maintain even if sales fall. That may explain why operating income fell to $3.7 billion in the most recent quarter from $8.9 billion in the same quarter the prior year.

Shareholders show their approval

This purchase follows a story by The Wall Street Journal that said Amazon was reducing the number of private-label items it sells on its website. Those products tended to be lower-margin, lower-priced items that were becoming more expensive to fulfill. The business was also causing Amazon regulatory scrutiny, because it was said to be competing against third-party sellers that list similar products on the site.

Investors are cheering these recent moves; Amazon's stock has been up 12.7% in the past month. Nevertheless, many hope this is just the beginning with similar decisions ahead.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.