This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

What happened

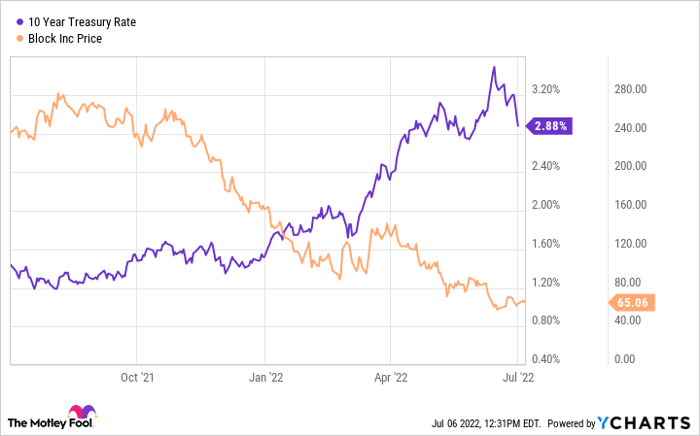

Shares of fintech company Block (NYSE: SQ) -- formerly known as Square -- tanked by 61.9% during the first half of 2022, according to data from S&P Global Market Intelligence. That was a far worse performance than the S&P 500 and Nasdaq Composite indexes, which fell by 21% and 31%, respectively, from their all-time highs.

So what

There were many reasons for Block's steep drop. The biggest factor was rising interest rates. In an attempt to get inflation under control, the Federal Reserve in March began lifting its benchmark federal funds rate from the near-zero it had cut it to at the start of the pandemic to an upward limit of 2% as of June. More rate hikes are expected following the next two Fed meetings in July and September. The federal funds rate is still at a historically low level, but the speed and magnitude of the rate changes have dragged down Block and other high-growth but richly valued stocks. There is an inverse relationship between interest rates and the present value of risk assets like stocks. Thus, rising rates generally lead to lower stock prices.

Data by YCharts

Some investors were also skeptical of Block's bets on the Bitcoin (CRYPTO: BTC) blockchain network -- the reason for the corporate rebrand from "Square" to "Block." It will take years for these efforts to pay off, if they do at all, since there are other competing crypto networks also vying for developer attention. Block also made a big acquisition, picking up "buy now, pay later" outfit Afterpay in an all-stock deal.

And, of course, there are the growing worries that the U.S. may be headed for a recession. The economy has multiple headwinds working against it this year, and some economists think a recession is already underway. If the consumer takes a hit, Block's growth momentum could be negatively impacted.

Now what

The good news is that despite all of these issues, Block is still in fast expansion mode as individuals and small businesses rapidly adopt its digital finance platform. Gross profit (revenue minus the cost of revenue) was $1.29 billion in Q1 2022, a 34% year-over-year increase. Profitability, as measured by free cash flow, also rose to $188 million.

After its epic share price decline in the first half of 2022, Block trades for 34 times trailing-12-month free cash flow. That's still a premium price tag, but if the fintech leader can continue its growth streak over the next few years, it could be a worthwhile value for investors who buy and hold. Just remember to make Block part of a well-diversified portfolio if you do choose to invest in it.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.