This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

During the first half of 2021, meme stocks like GameStop (NYSE: GME) and AMC Entertainment (NYSE: AMC) took the financial world by storm. Individual investors piled into shares of a handful of companies -- particularly beaten-down, heavily shorted stocks -- quickly making huge gains. As the stock prices soared, many of these traders used social media platforms to celebrate and to urge others to continue buying.

Over the past year, though, meme stocks have lost much of their lustre. Indeed, meme stocks' best days are probably behind them. In the long run, they simply cannot escape the underlying companies' poor performance.

Maintaining excitement is hard

The surge in meme stocks last year was surprising, but it wasn't unprecedented. There have been many such stock market 'bubbles' over time. However, these bubbles pop sooner or later.

In the early days of the meme stock craze, watching stocks like GameStop and AMC rocket higher was exciting. As the stocks rose, they gained more mainstream interest, leading to additional buying and even bigger gains.

But as time went by and meme stocks' gains slowed, most investors began to tune out. The resulting stock price declines made meme stocks even less exciting to the average American, as they no longer seemed like a ticket to quick riches.

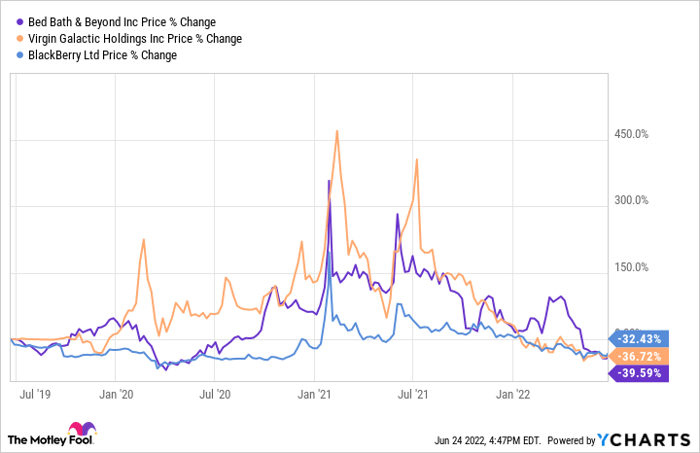

The need for a devoted band of followers to prop up the share price has already doomed lesser meme stocks. For example, shares of Bed Bath & Beyond, Virgin Galactic, and BlackBerry made big gains during the peak of the meme stock craze. But over the past year, all three stocks have plummeted below pre-pandemic levels.

Three-year performance of selected meme stocks, data by YCharts.

Even AMC stock has risen less than 20% over the past three years, underperforming the broader market. Only GameStop has maintained big gains compared to 2019. And despite being the most popular meme stock, GameStop shares have fallen more than 70% from the all-time high of $483 they reached in January 2021.

A stag hunt doomed to fail

The "stag hunt" scenario from game theory also helps explain why meme stocks are poised for losses over time. In a stag hunt, everyone must work together to achieve the best outcome (capturing a stag). The risk is that some people settle for a sure thing with a smaller reward (catching a hare) and allow the stag to escape.

By acting as a group to buy (and not sell) shares of GameStop, AMC, and other names, meme stock investors generated huge paper profits last year. Even today, meme stock bulls continue to urge other investors to buy and "hold on for dear life" no matter what.

Maintaining this kind of cooperation over time is hopeless, though. Eventually, some people will choose to sell, perhaps to make a big purchase or perhaps simply to take some risk off the table. That's exactly what has happened over the past year, bringing meme stocks back to earth.

No substance to these stocks

Many years ago, investing legend Benjamin Graham aptly described the phenomenon behind meme stocks' performance. According to his most famous student -- Warren Buffett -- Graham said, "In the short run, the market is a voting machine ... but in the long run, the market is a weighing machine."

In other words, at any moment, a stock can be popular or out of favour for no good reason. But over time, a company's fundamental performance (i.e. revenue, earnings, and cash flow) is the main driver of its share price. Meme stock investors are learning this lesson the hard way.

Even at today's levels, shares of GameStop and AMC are extremely overvalued. GameStop is deeply unprofitable and burning cash rapidly. Its main growth initiative -- an NFT marketplace -- seems unlikely to fix things, given that crypto giant Coinbase's NFT marketplace has been a bust. GameStop's intrinsic value is probably closer to $1 billion than its current market cap of $10 billion.

Meanwhile, AMC would have trouble supporting its $5.5 billion debt load even if revenue and earnings returned to 2019 levels. And while theater attendance is improving, revenue remains well below pre-pandemic levels. That makes AMC's $6 billion-plus market cap very hard to justify.

In short, while the past year has been rough for meme stock investors, the future could be even worse, barring an unlikely surge in profits at GameStop and AMC.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.