This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Tesla (NASDAQ: TSLA) CEO Elon Musk is as polarizing of a figure as they come. On one hand, he has propeled the electric vehicle (EV) industry forward from a doubted concept to become a trend that legacy automakers are trying to ride. But he also receives criticism for actions like his online behavior and making a multi-billion-dollar offering to buy Twitter (NYSE: TWTR).

However, there's no denying that Tesla is a remarkable company. Tesla stock is up on the year while the Nasdaq Composite is down 13% and virtually every major carmaker to EV newcomer -- from Toyota to Rivian Automotive, is down 5% to 66%. Here's why Tesla continues to defy the Nasdaq's gravity in 2022, and whether the stock is a good buy now.

1. Tesla is outperforming the competition

Tesla tends to report its quarterly production and delivery numbers about two to three weeks prior to its earnings report. On April 2, Tesla reported quarterly production of 305,407 units and deliveries of 310,048 units, which was a big jump from Q1 2021 results of 180,338 units produced and 184,800 units delivered. However, the quarter-over-quarter growth marked a major slowdown compared to what investors were used to, as Tesla produced 305,840 units in Q4 2021 and delivered 308,600 units. Tesla attributed the slowdown to supply chain challenges and factory shutdowns.

However, Tesla's growth outlook is favorable. The company began production and delivery from its Berlin factory in March and just started production from its Texas factory in April. The opening of the two new factories will alleviate pressure from Tesla's Shanghai factory and could allow it to keep managing supply chain challenges and the global chip, material, and battery shortage better than its peers.

In its recent investor presentation, Tesla said that it began deliveries of its crossover SUV, the Model Y, from its Texas factory and Germany factory -- while also making an effort to move battery cell production in-house and diversify its supply chain and procurement process.

In sum, Tesla is showing resilience during an industrywide shortage while charting a path toward another record production and delivery year in 2022.

2. Tesla is growing faster than ever

Even with lower Q1 2022 production and delivery figures, it's worth mentioning that Tesla's revenue, earnings, and free cash flow growth continue to impress investors.

The company recorded Q1 2022 automotive revenues of $16.86 billion, a year-over-year increase of 87%. In Q1 2022 alone, Tesla produced 36% of the automotive revenue it earned for all of 2021.Tesla cited its increased selling price as one of the reasons for higher revenue growth.

Despite the higher revenue, Tesla's operating expenses were about the same at $1.86 billion compared to $1.62 billion in 2021 -- just 15% higher despite total revenues being 81% higher. Similarly, Q1 2022 net cash provided by operating activities was 143% higher compared to Q1 2021 but capital expenditures were only 31% higher, while led to free cash flow of $2.23 billion -- the second-highest quarterly performance ever. Tesla ended the quarter with $17.51 billion in cash and cash equivalents on its balance sheet.

3. Tesla is more profitable than ever

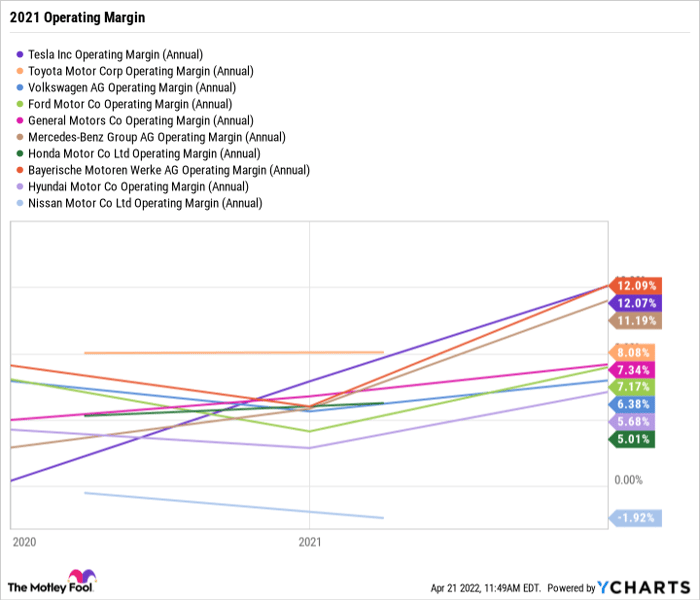

One of Tesla's most impressive stats is its operating margin. Unlike gross margin, which factors in the cost of goods sold, the operating margin also factors in operating expenses like utilities, wages, selling, general, and administrative expenses, sales and marketing, research and development, and other costs that are related to running the business. Tesla notched a record high operating margin of 19.2% in Q1 2022, meaning for every $1 it made in revenue it earned an operating profit of 19.2 cents. For comparison, here are the 2021 operating margins of major automakers, including Tesla.

TSLA Operating Margin (Annual) data by YCharts

Tesla cited higher vehicle deliveries, increased average selling prices, reduced cost of goods sold, lower stock-based compensation, and increased regulatory credit sales as profitability drivers that offset higher raw material costs, commodity, logistics, and shipping costs and an increase in operating expenses.

In an industry constrained by rising raw material costs, rising parts and components costs, higher shipping and freight costs, and higher labor costs, it is impressive to see Tesla grow its operating margin when other major automakers will likely report lower operating margins in the quarters to come.

Tesla is a phenomenal company but an expensive stock

The investment thesis for Tesla remains intact. And in many ways, it is becoming harder to argue that Tesla isn't the best global automaker. It has the greatest growth prospects, the best technology, and is ahead of the curve while the competition tries to catch up, it continues to deliver on its promises. Tesla is more profitable than ever and it has its own charging network plus investments in solar energy and energy storage. It also has a lean business model that doesn't depend on the dealership network. But as Warren Buffett famously said, "you pay a very high price in the stock market for a cheery consensus." Put another way, great companies are often expansive stocks. And that logic applies perfectly to Tesla.

Tesla's market cap is $1.08 trillion. It earned adjusted diluted non-GAAP earnings per share (EPS) of $3.22 in Q1 2022. So even if Tesla continues to grow earnings and earn, let's say $15 in adjusted 2022 EPS, it would still have a forward price to earnings ratio of roughly 70. Tesla stock is by no means cheap. And it shouldn't be -- it's a really really good business. For risk-tolerant investors who are optimistic about the growth of the EV industry, adding Tesla to a diversified basket of EV stocks isn't the worst idea so long as it's understood that Tesla stock is prone to sharp gyrations to the upside and downside. In the last year alone, Tesla stock has been as high as $1,243.49 per share and as low as $546.98 per share.

As with every business, it's important to understand what you are buying and why you want to own it. With Tesla, the investment thesis is simple. It's a bet on the long-term growth of EV adoption via buying the industry leader for a premium price. For some folks, that's a thesis that makes sense. But for others, the electric car stock may simply be an impressive company that is just too expensive to consider now.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.