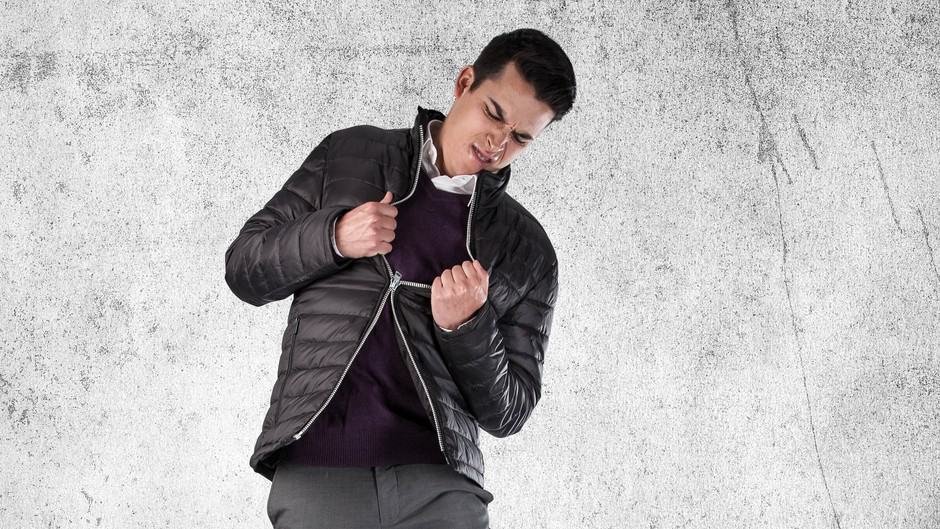

There's no better way to put it — the Zip Co Ltd (ASX: Z1P) share price has been in a world of pain recently.

Since hitting a high of $12.35 in February 2021, shares in the buy now, pay later (BNPL) payment provider have tumbled 90%. For shareholders, the bleeding decided to continue throughout this week as shares have continued to fall 21% to solidify a new multi-year low at $1.24 per share.

Without any critical announcements being made, what could have put such a sour taste in investors' mouths this week?

Questions hang over the BNPL business model

While the boom in BNPL shares raged on between 2018 to 2021, some doubts over the sector's profitability prospects were shared. However, for some, the eye-watering rates of revenue growth being witnessed put those concerns on the back burner.

Fast forward to this week, and those same suspicions around future profitability were back on the table. The half-year results for BNPL operator Afterpay, now owned by Block Inc (ASX: SQ2), were unveiled, and it wasn't pretty for the bottom line.

Based on the report, Afterpay's net loss after tax opened up like a hellacious abyss — engulfing $345.5 million of the company's money for the six-month period. For context, the comparable period involved $79.2 million of money burning.

The massive money spend mostly resulted from an uplift in employment and marketing expenses. This begs the question: is Zip also throwing piles of cash at additional marketing to maintain market share? And, is the BNPL industry really big enough for all these players to coexist?

Evidently, these questions have raised concerns for Zip and its share price. Although, the company narrowed its losses from $455.9 million to $172.8 million in its last half-year report. Prior to this result, Zip's net losses for the trailing 12-month period were sitting at $658.8 million (as shown above).

Is there a way back for the Zip share price?

As my colleague, Tristan recently covered, Australian broker Ord Minnet is still optimistic about what the future may hold for Zip shares.

In essence, Ord Minnet highlighted that the BNPL company has continued to show growth across its core business. This, paired with the accretive transaction of competitor Sezzle Inc (ASX: SZL), poses reason to believe there is light at the end of the tunnel.

The broker holds a Zip share price target of $4 apiece. This suggests a potential three times return on an investment made at the current price.