AMP Ltd (ASX: AMP) shares have started this week in the green, up 0.5% at $1.01. This appears to be the new watermark price for the ASX financials company, according to my Fool colleague Zach.

During March, the AMP share price climbed 2 cents from 95 cents to 97 cents — a 2.11% gain. By contrast, the S&P/ASX 200 Index (ASX: XJO) moved at triple the pace, up 6.4%.

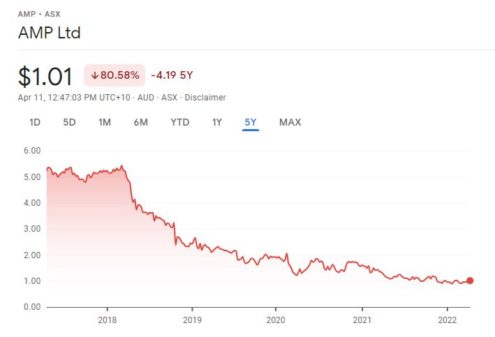

The AMP share price has been in a gradual downwards spiral since the Banking Royal Commission in 2018, which uncovered dastardly behaviour within many financial institutions. AMP was amongst the companies exposed for the worst conduct, prompting a restructure of the business that continues to play out today.

Since then, the AMP share price has consistently fallen and is now about 80% down overall. It appears that AMP might have finally stopped the bleeding around the end of the third quarter of 2021, when the share price hit the $1 mark and seemed to settle there. It has been rangebound since then.

AMP's restructure continues…

The latest news on restructuring came on 28 March. AMP announced it had finalised the sale of its Global Equities and Fixed Income division to Macquarie Group Ltd (ASX: MQG).

As my fellow Fool Sebastian reported, the sale helps set AMP up for the planned demerger of its Collimate Capital division. The sale to Macquarie Asset Management will see roughly $47 billion in assets under management transferred to Macquarie. In return, AMP will receive $63 million in cash, with the possibility of another $75 million down the road, depending on some conditions.

Boosted profitability ahead?

Bloomberg Intelligence analysts Matt Ingram and Jack Baxter say AMP's restructuring efforts should boost profitability in the future.

In a note last week, Ingram and Baxter said:

AMP's extensive restructuring, which should be complete by June 30, may lift 2021's 9% ROE [return on equity] and 64-basis point margin, particularly given AMP Capital's below group 40-basis point result in 2021.

AMP said the bank's margin would fall to 1.5% this year from 2021's 1.62%, but we believe 2023 may be better — AMP's guided cash-rate rise from as early as June may lift returns.

It needs to fix the Australian wealth management unit which returned just 5.4% in 2021, but capital reallocation to a higher-return business may boost ROE.

Credit Suisse analysts say consumers are starting to regain confidence in professional advisors.

"Inflows continue to improve across the industry underpinned by structural growth in the demand for advice and a return of consumer confidence to the advice industry," they said in a note to clients.

Outflows at AMP have reduced substantially over the past few weeks, the broker remarked.

Could AMP embark on a dividend splash?

Ingram and Baxter speculated that $381 million in total surplus capital (as of 31 December 2021), which AMP generated through capital budgeting initiatives last year, could fund a dividend bonanza for ASX investors.

"AMP could distribute A$400-$600 million in 2022, lifting dividend yield above 14% and smashing consensus' 1.5 Australian cent dividend on better profit and up to A$350 million surplus capital," they noted.

In fact, the pair reckon AMP's surplus could "support a 2022 dividend payout of 50%".