This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

It's easy to look at a stock like Amazon (NASDAQ: AMZN) and think that at $1.7 trillion, it can't possibly go much higher in value than where it is today. But as long as a company has ways to continue growing, there's no reason its valuation won't also increase. And there's no danger for this cash-rich business to run out of opportunities anytime soon.

In just three charts, investors can see why, despite its massive size, Amazon can still be an excellent long-term investment.

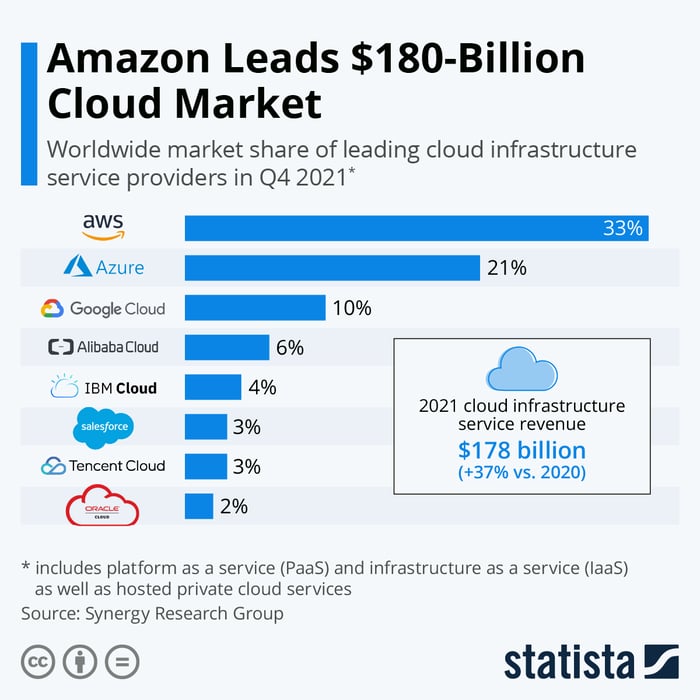

A leader in the cloud market

Although Amazon is primarily known for being a top online retailer, its cloud business, Amazon Web Services (AWS), has also made a name for itself in the industry. Many top companies use AWS, including software company Intuit, top bank HSBC, and COVID-19 vaccine maker Moderna. And as a leader in the cloud market, it'll undoubtedly continue to be a top choice for many businesses that expand their presence online.

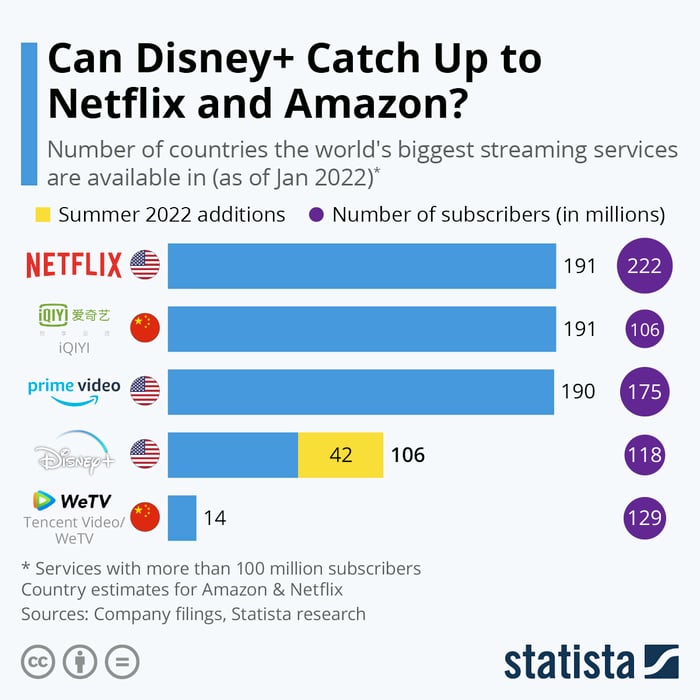

Its streaming service is among the top in the industry

Amazon Prime Video has over 175 million subscribers and is among the top streaming services in the world. An important caveat here is that Amazon Prime Video is included within an Amazon Prime subscription, and so these numbers likely would be lower if the company were only offering it as a stand-alone service the way Netflix and Walt Disney do their services. But it's another example of how Amazon has room to grow in another area -- streaming.

Last year, the company secured a deal with the NFL where it would spend a reported $1 billion per year for exclusive rights for Thursday Night Football games. It's a 10-year deal that starts next year and will help diversify its streaming services; Netflix, for comparison, does not have any live sports available for subscribers to watch. Amazon can spend a lot more money to expand into its streaming business to make it more robust and possibly lure subscribers away from other services.

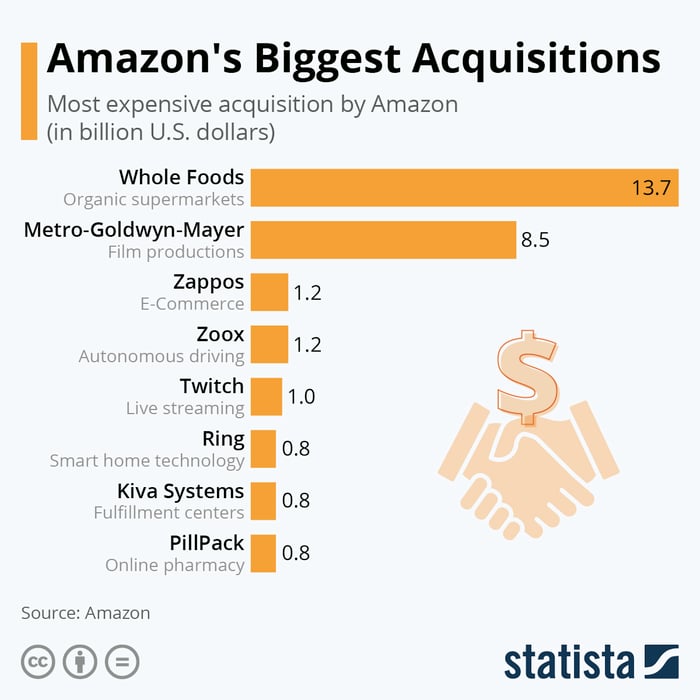

Amazon has been investing in various industries

In 2021, Amazon generated $46 billion in cash from its day-to-day operating activities. The year before that, its cash from operations was north of $66 billion. The company is bringing in truckloads of cash every year and that puts it in an excellent position to spend on acquisitions to expand its business even further. Here are the biggest deals the company has made in recent years:

From autonomous driving to supermarkets to an online pharmacy, Amazon has been expanding its reach into various sectors. It can grow deeper into any one of these sectors or it can pursue yet another new one altogether. Either way, given the cash that Amazon generates each year, it won't struggle to find a new growth avenue to pursue.

Should you invest in Amazon today?

Amazon just continues to get bigger over the years. In 2021, revenue of $469.8 billion was more than 67% higher than the $280.5 billion that the company reported in 2019, before the pandemic emerged. Online shopping is more popular than ever before and even if that slows down in a return to normal, the company can simply shift to other areas of its business, such as pumping more money into Whole Foods or developing its telehealth capabilities.

For buy-and-hold investors, Amazon is one of the safer growth stocks to hang on to over the long term. The business is a beast when it comes to cash flow, and with so many opportunities for growth, this is an unstoppable company to invest in. Up just 6% in the past year, while the S&P 500 has climbed 14%, the stock has underperformed the markets of late -- but that isn't a trend investors should expect to continue. It may only be a matter of time before this growth stock starts rallying again, and now may be as good a time as any to load up on it.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.